|

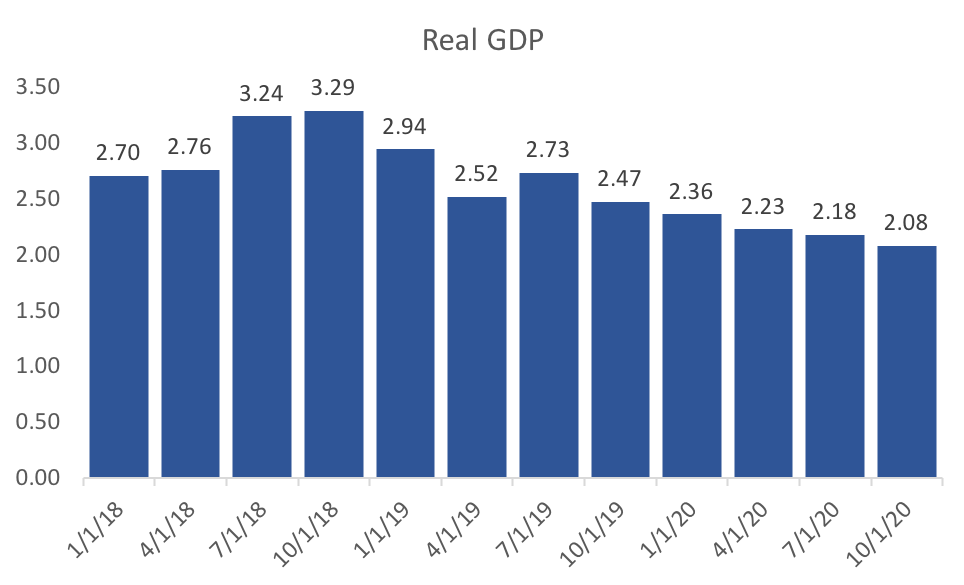

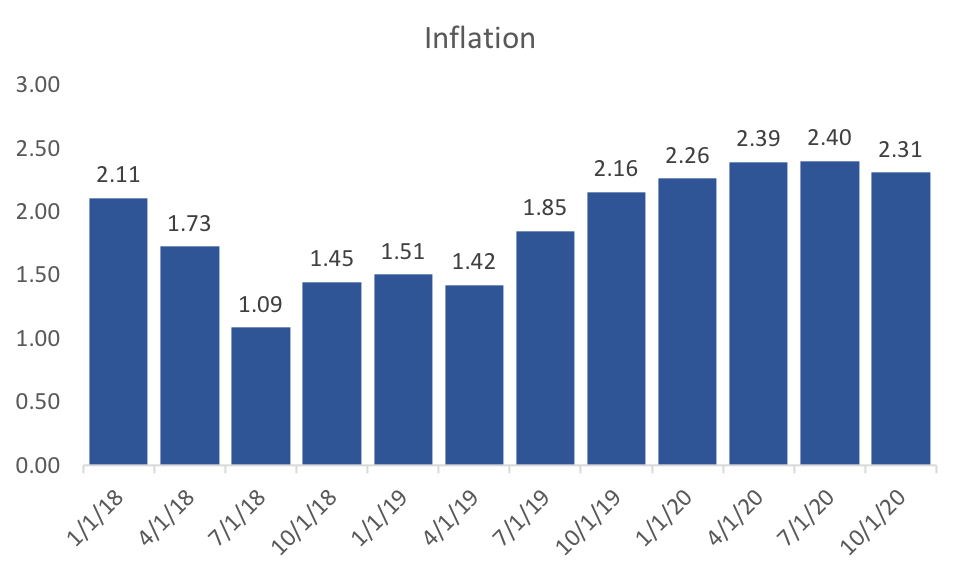

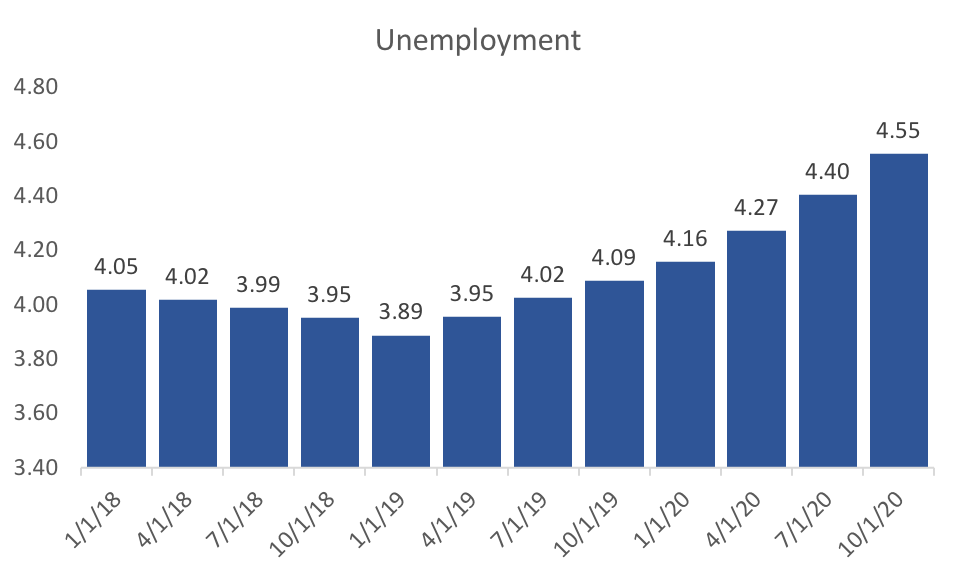

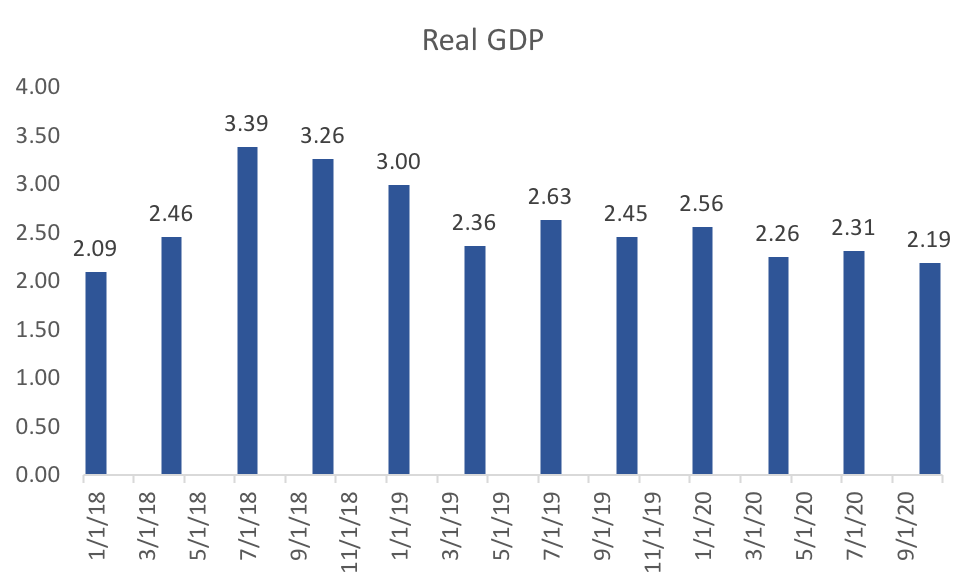

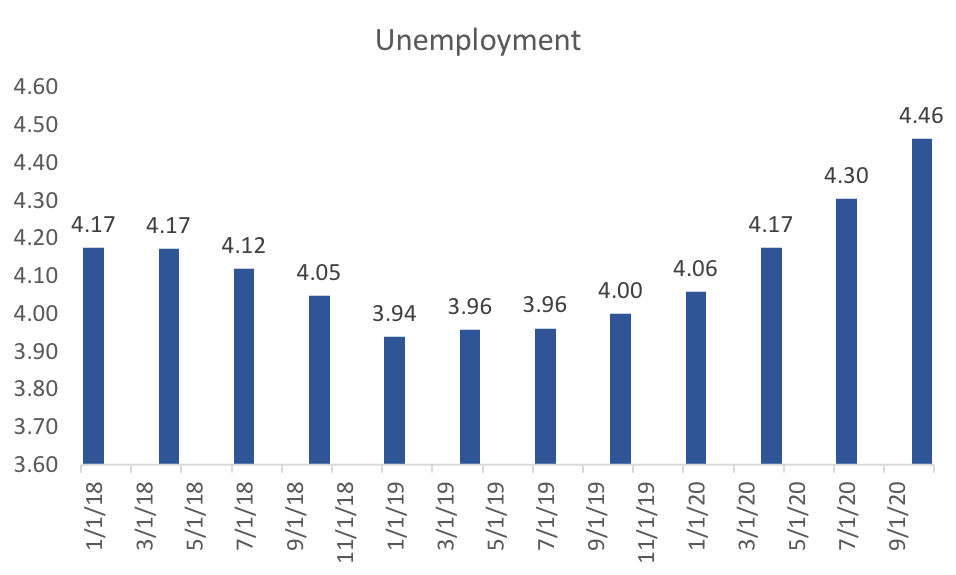

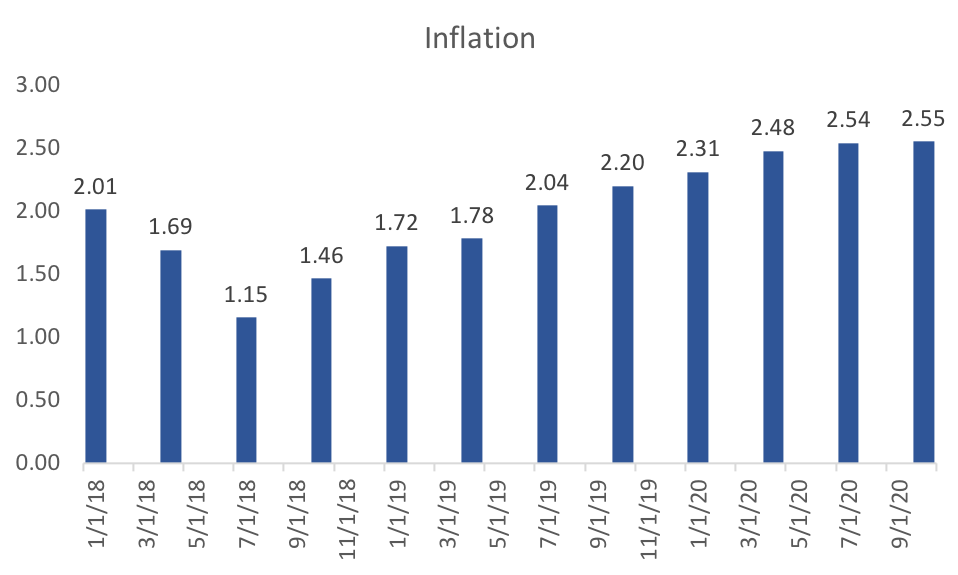

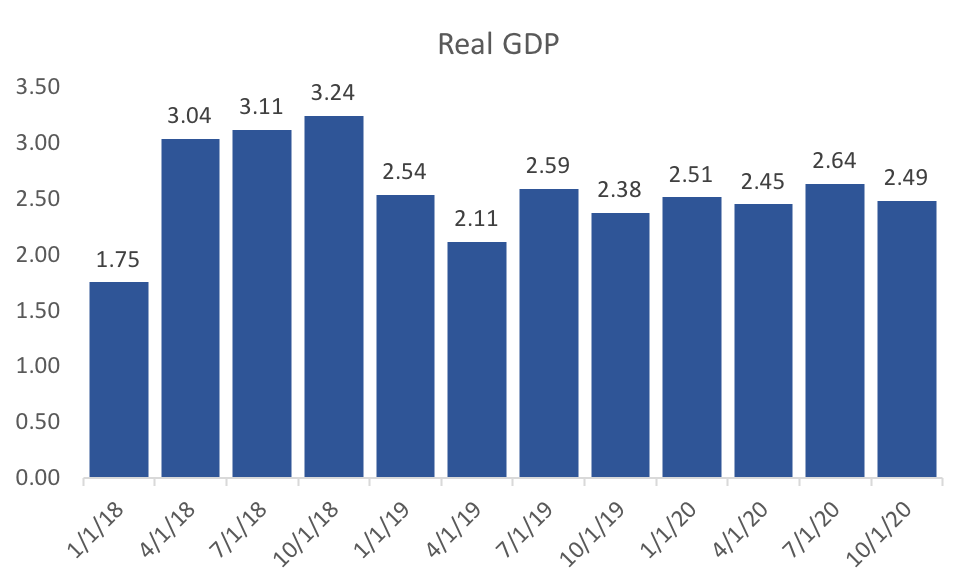

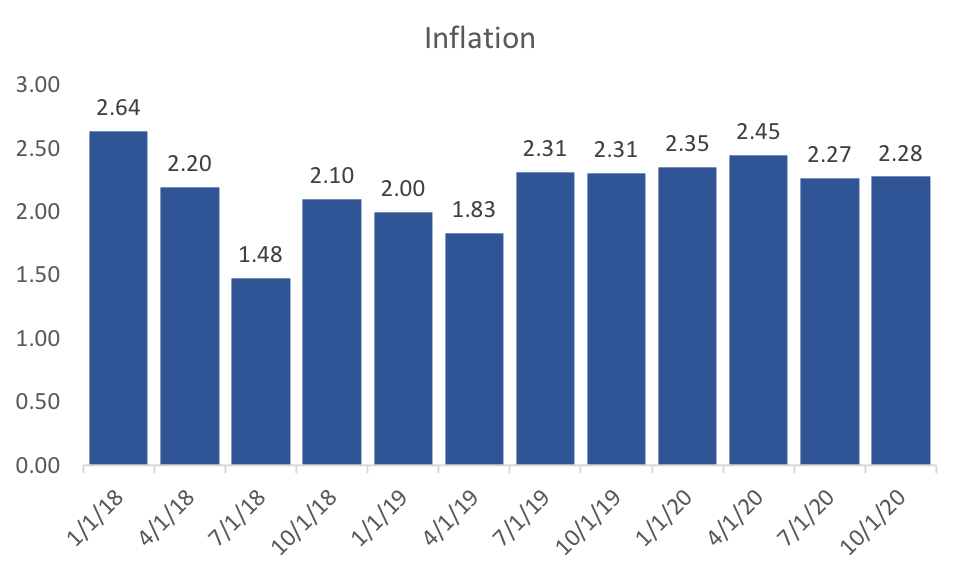

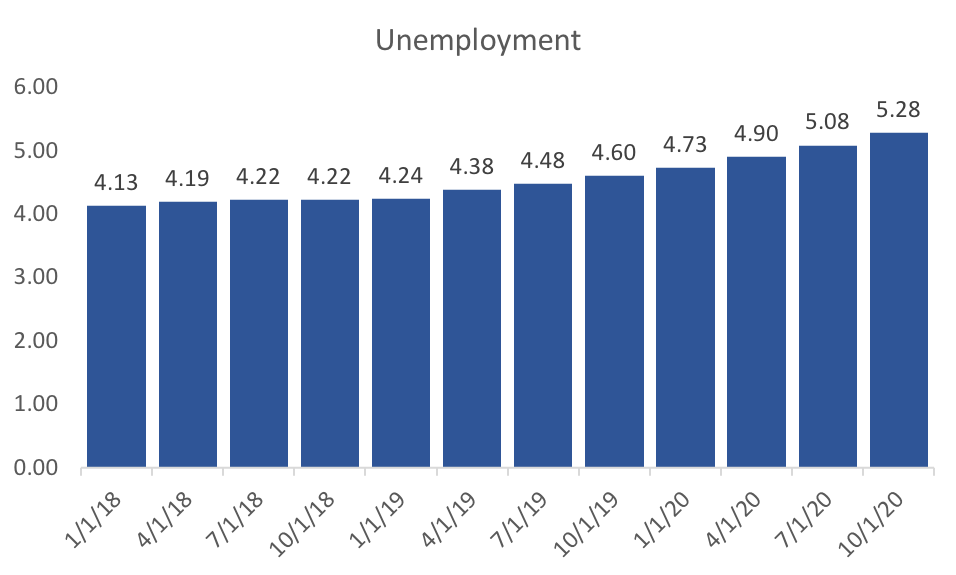

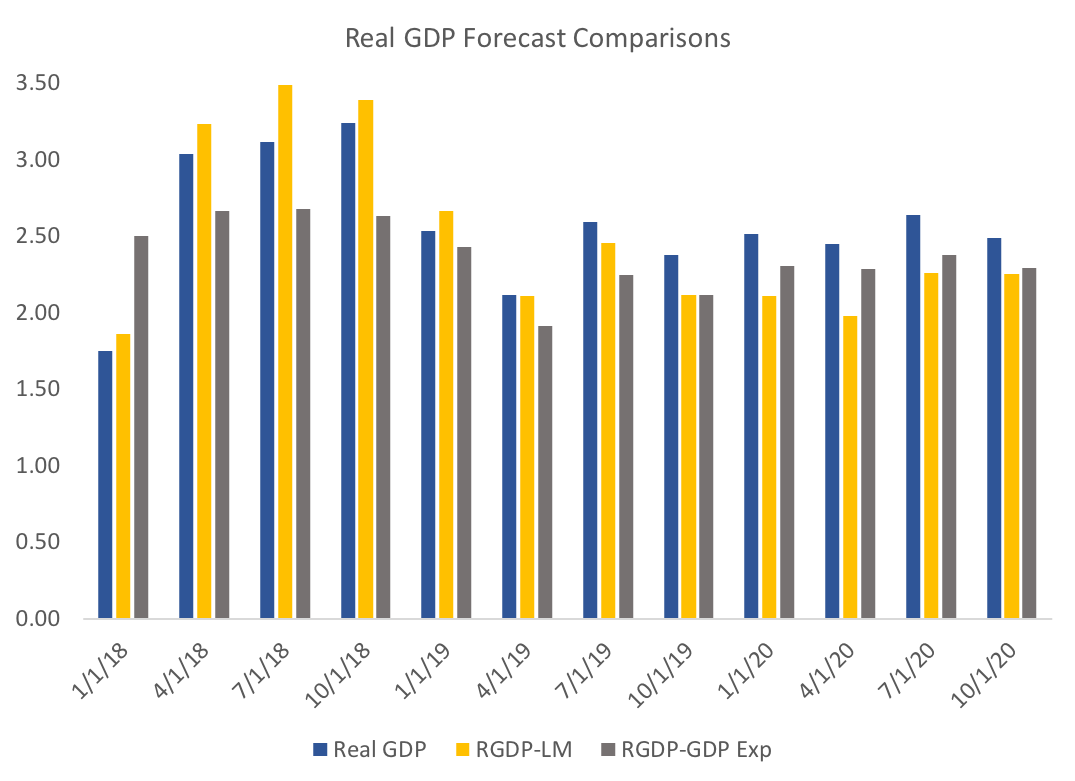

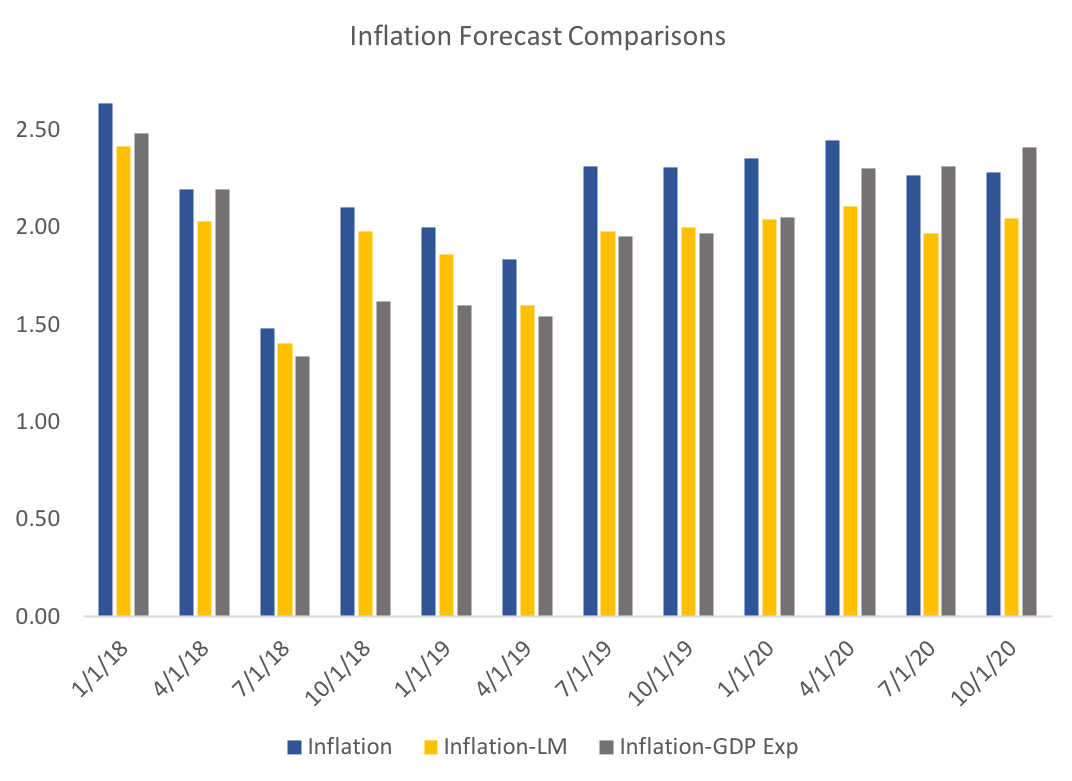

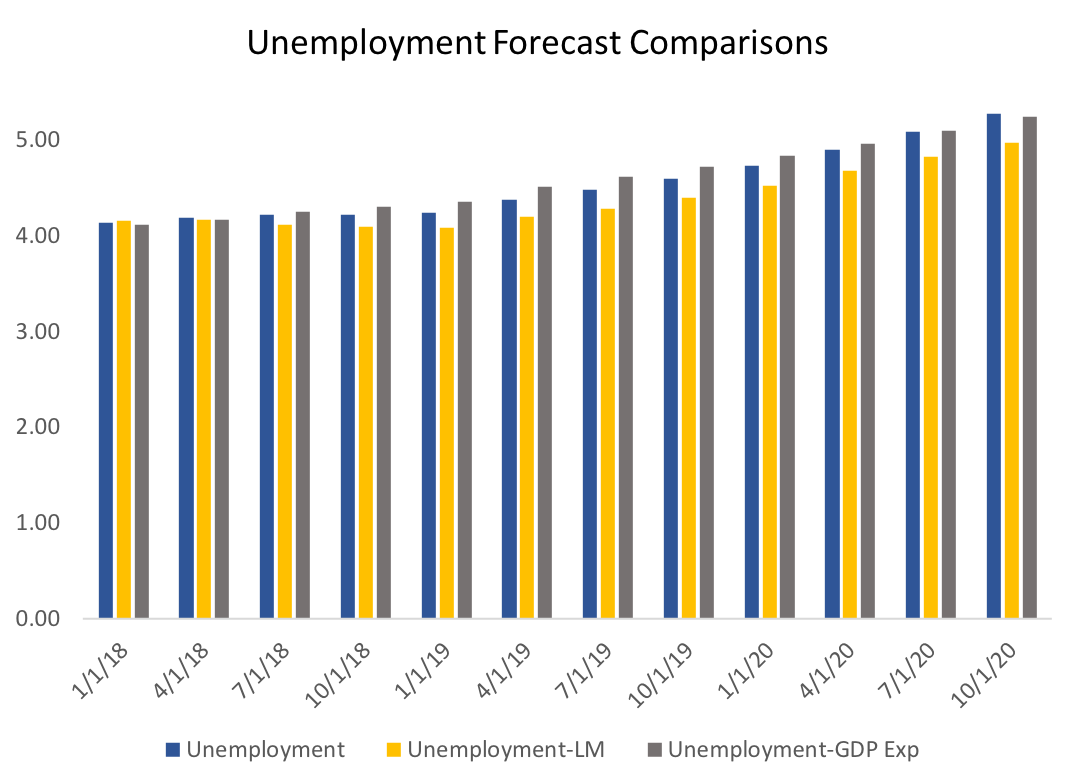

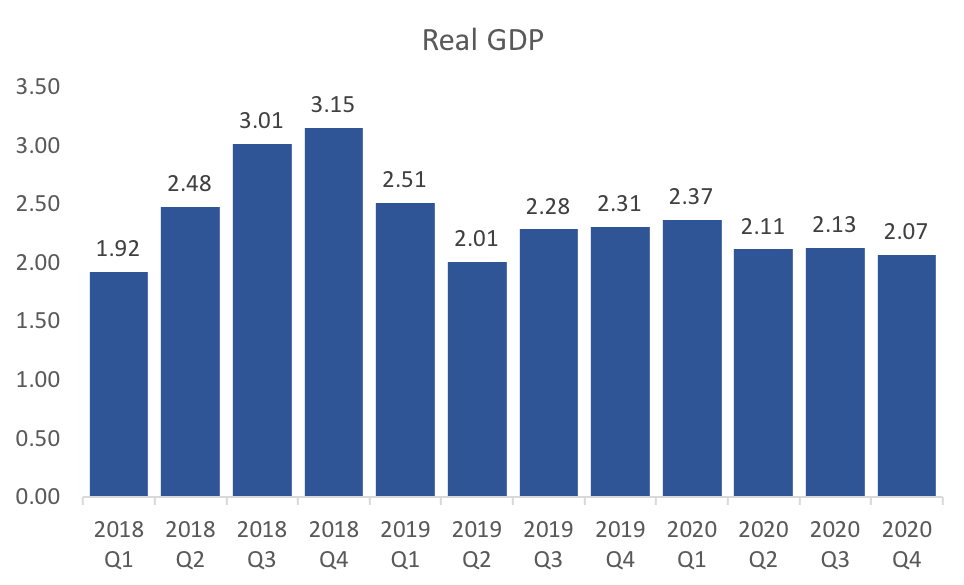

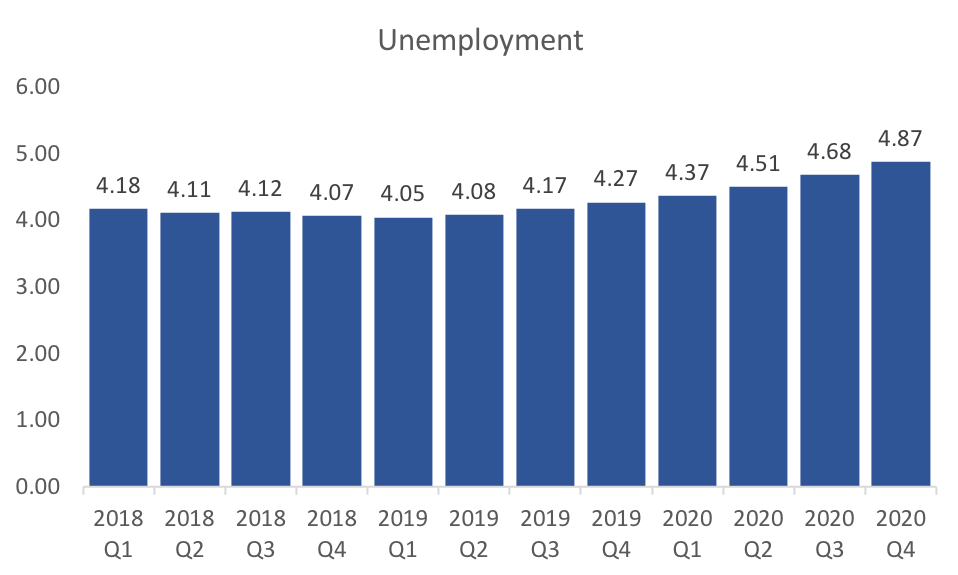

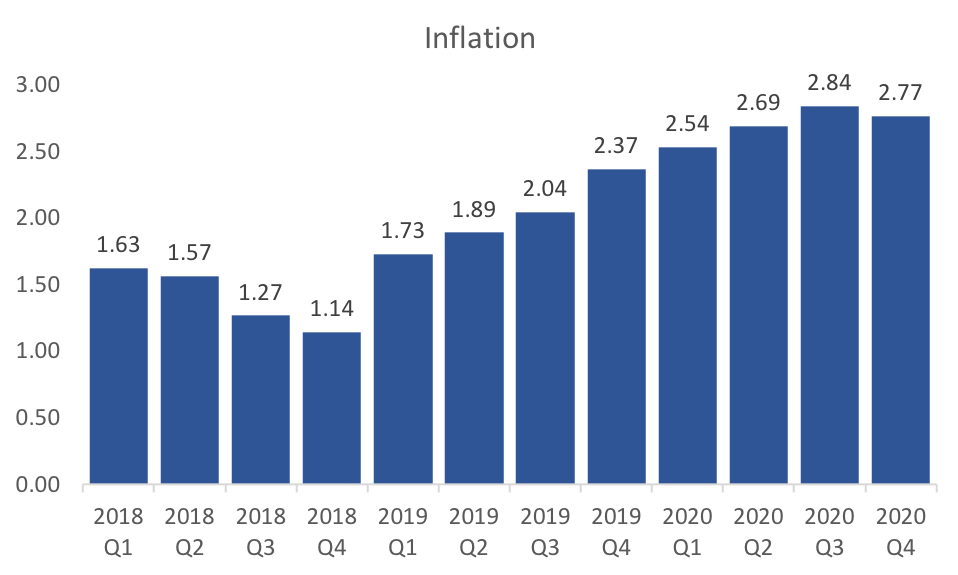

The new data and data revisions of the past month have generated positive changes in my US forecast model. While the model still predicts a drop off of real GDP growth through the end of 2020, the rest of 2018 and the beginning of 2019 reflect the short-term fiscal stimulus. The model implies that by the end of 2020 we will return to the long-run average of about 2 percent. It would by incorrect to assume that the long-run forecast implies that there will not be a recession in 2020, since the model is not designed for long-run recession forecasting. The recent increase in the federal funds rate has had a marked impact on the models inflation forecast, with inflation slowing through the end of 2019. This is, of course, the objective of monetary policy makers, and I suspect that the model is being overly pessimistic about Q3 2018. The models unemployment forecasts are starting to fall more in line with recent data releases. The trough of unemployment is still predicted in early 2019, with accelerating increases in unemployment through 2020. This could signal the potential for a recession by the end of 2020, and certainly would suggest that an economic head-wind or two could set off a recession in 2020. Just as I did in the previous month's forecast, I provide my aggregated expectations of inflation, real GDP growth, and the federal funds rate below.

0 Comments

The latest WSJ economic forecasts were released yesterday, and they mostly confirm a stable trajectory for the rest of the year. Q2 GDP growth expectations jumped a third of a percent to 3.58 percent. Yields are holding steady with an expected cessation in contractionary monetary policy by the end of 2019, with the Fed Funds expected to reach 3 percent. Unemployment rate projections continue to fall through the trough is still likely to occur in mid-2019.

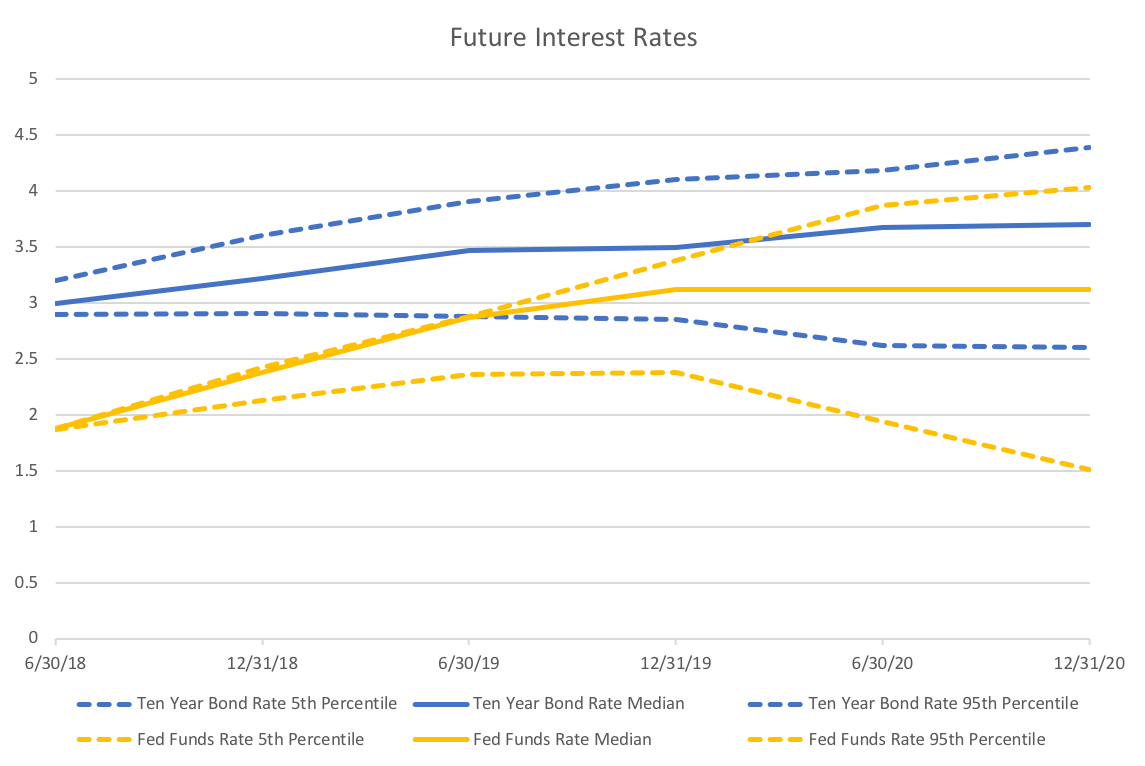

While the revisions mostly suggest a current robust state of the economy, there were some negative indicators. The consensus recession probability ticked up by more than one percent to almost a 16 percent chance of a recession in the next 12 months. While expected growth in 2019 is slightly above US long-run average, the current expectations for 2020 suggest a possibility of a recession. Supporting this evidence: the expected yield curve spread (bond yield minus the federal funds rate) in 2020 is only half a percent, while the expected spread for June 2018 is over 1 percent. Taking this all together, the short-run looks quite good, but there are clouds on the medium to long-run horizons. Using the most recent data including updated aggregate expectations, I have a new set of headline forecasts. First quarter data on international trade and finance have yet to be released, so these forecasts still rely on estimates of the Q1. Second quarter real GDP has dropped significantly (almost half a percent) from last month, whereas first-quarter forecasts increased to fall in line with the advance estimate. The end of 2018 still looks to be quite strong, before mellowing to long-run average growth in 2020. Despite an apparent level shift (the newest unemployment data suggests my Q1 forecast is too high by 0.2 percentage points), my unemployment forecasts see further declines into 2019 before steadily climbing in 2020. That acceleration in unemployment is consistent with a significant recession beginning in the third or fourth quarter of 2020. My model's forecasts of inflation suggest that the Fed's projected rate increases will keep inflation in check through 2019. There is a lot less variability in this set of projections compared to last month. The decline in inflation through 2018 seems robust, as does its eventual rise in 2020. To round off this months forecast, I include the aggregate estimates of Inflation, GDP, and the federal funds rate. Inflation and GDP expectations remain high despite a (well-founded) belief of a rising federal funds rate.

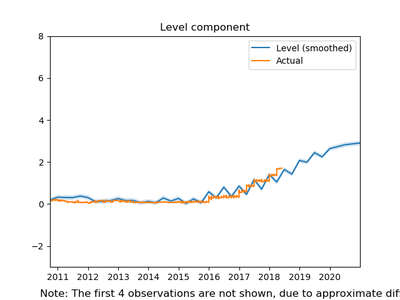

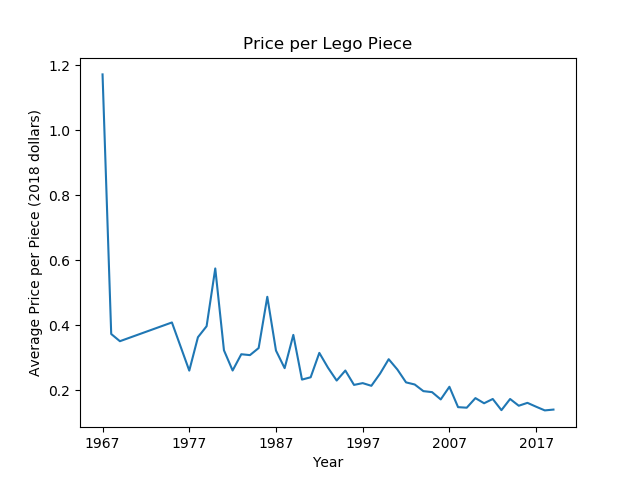

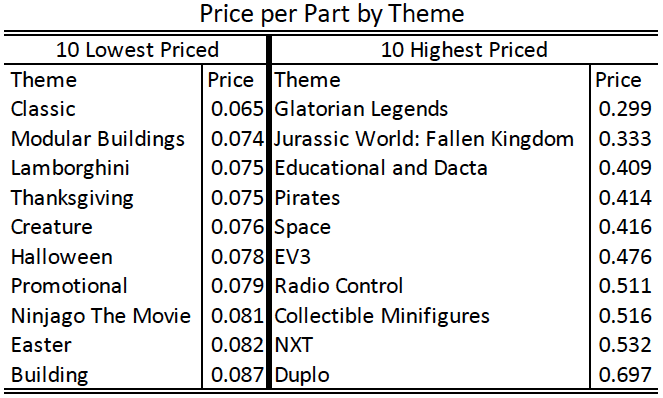

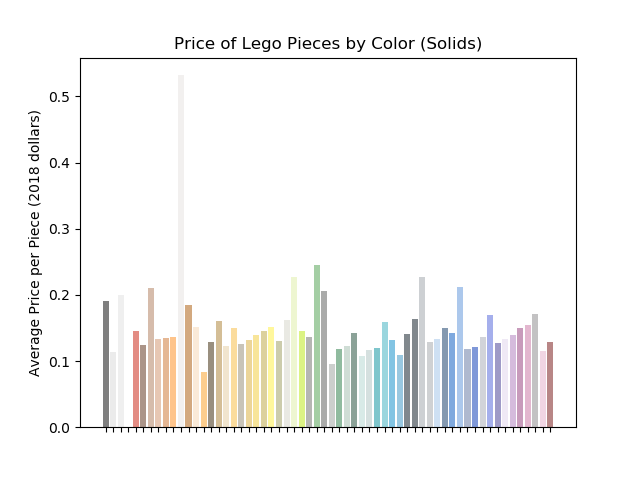

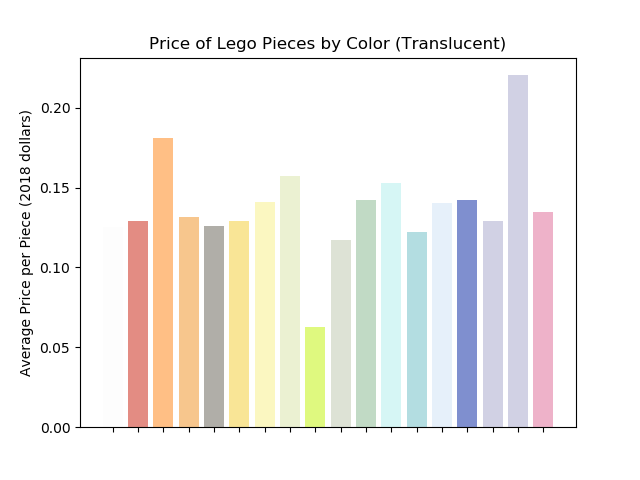

I love playing with Legos. I love playing with data. So when I got a chance to play with Lego data, I had a ton of fun. I have seen analysis of Lego prices (this 2013 article on lego is my favorite), but I thought I might be able to do something different, with the most recent data. Using the rebrickable database, for detailed set information, and a scrape of the brickset website, for retail prices, I created a dataset of real price per piece, that is I control for inflation. Like many people who have looked at Lego prices, the real price per piece does appear to be declining over time: To dig further into the data I restricted my analysis to the last 10 years. Sorting the data by theme we see that the cheapest sets are the special holiday sets and themes with very large sets. I was surprised that the Modular Buildings were so cheap. Classic, makes sense because they are the most basic bricks, but the Modular Building theme typically has many specialty pieces. Most of the highest priced themes are also not to surprising, the sets that have electrical circuitry are more expensive. I was surprised by Pirates and Space being so high up on the list though. However, I wanted to have a little fun. The rebrickable dataset gives the inventory for each set, and their colors. Using the frequency of the color in each set I reweigh the price per piece by the frequency of color. The graph below shows the price by color for all the non-translucent pieces. If we look at translucent colors, it does look as though, in general, those colors are slightly more expensive: I can also break down price by individual piece and again the prices more or less follow expectations. Very small pieces are cheap, large pieces with electronics are more expensive.

So if your goal is to expand your lego collection, get those modular and classic sets, and enjoy your Lego builds! Another relatively quiet month in terms of economic news. The recent data has not done much to shift the views of forecasters very significantly. One of the special questions in this months survey was regarding the timing of the next recession. Ben Leubsdorf of the WSJ does a great job discussing those responses. The big movers this month are crude oil price expectations, which jumped 5.5 dollars for June 2018, and the yield curve spread, which narrowed some more. Oil prices through the end of 2020 are expected to rise but with diminishing amounts, with December 2020 forecasts only rising 1.9 dollars. The yield curve spread is actually quite fascinating as I have noted in past reports. The graph above shows the yield curve tightening through 2020. More importantly, the variability of these forecasts is interesting as well. The difference between the 5th and 95th percentiles grows dramatically for the fed funds rate but is much more stable for the ten-year bond rates. It is unclear whether it is policy uncertainty or economic uncertainty that is driving this difference. However, it is strange that forecasters predict that the long rate will not respond, at least not one for one, to the stated Fed goal of raising rates at least two more time by the end of the year.

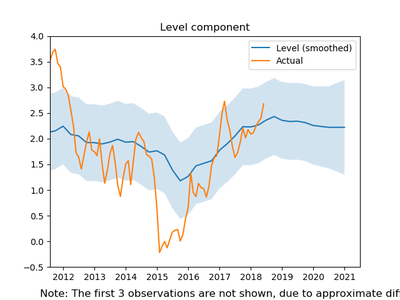

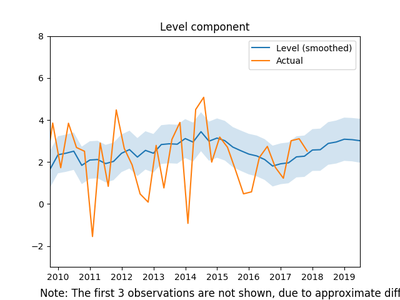

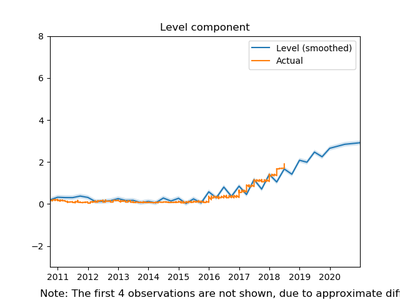

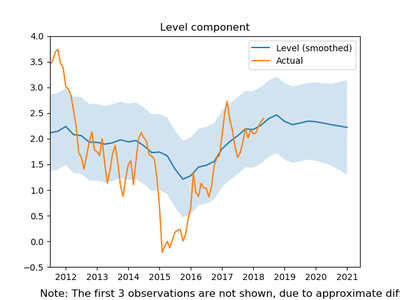

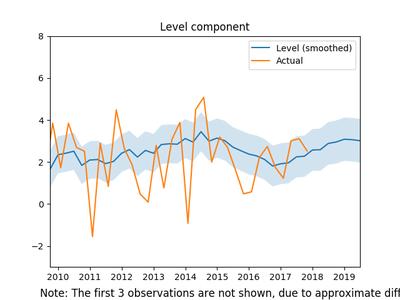

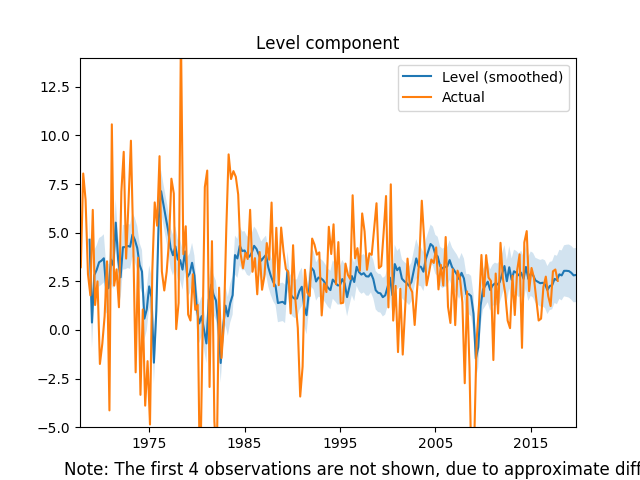

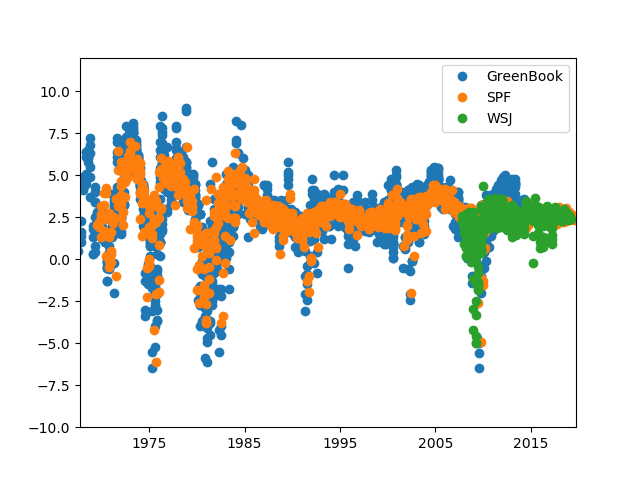

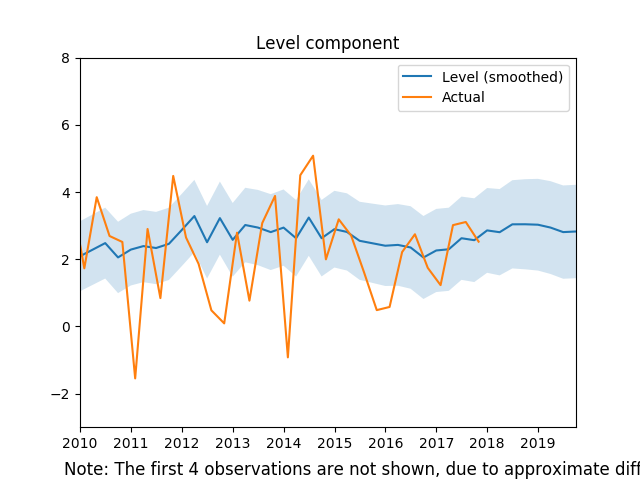

Another curiosity: even though the majority of forecasters expect a recession in 2020, they don't seem to think that the Fed will respond to it. If they did I would expect the median fed forecast to at least be fall from June 2020 to December 2020. However, the recession timing predictions are more or less consistent with the consensus unemployment forecasts hitting their low in mid to late 2019. About a month ago I produced my first forecasts of the US economy. This posts updates those forecasts given the new data available. The time-series model has several novel components. The most important of these components is aggregated expectations. Using expectations data from several sources I construct a new measure of expectations for real gdp, inflation and the federal funds rate. Instead of using the expectations directly (treating them as exogenous) I instead treat them as endogenous variables that are concurrently forecast with the VAR model. That is, I am forecasting the forecasts. Another novel component of my forecasts are constructed variables that measure the cycles within various "sectors" of the economy. In addition, to the four sectors in my previous forecasts (manufacturing, labor market, housing market, and financial market), I have also included an international sector. This might be an important addition given the recent discussions about tariffs and potential trade wars. The first step in the process creates cycles for each of the data series in each sector. Then, using dynamic factor analysis, I extract the common factor (or two) for each sector and use those in my forecasting model. The following three graphs display the quarterly forecasts of real GDP, CPI Inflation, and the unemployment rate. Below I dive into some detail to show the importance of expectations and the sectors in this forecasting model. Unemployment change significantly since last month indicating that we are currently in the trough and that unemployment will remain more or less stable until mid 2019. Inflation is expected to be quite high in the first quarter, but drops of pretty dramatically to the Fed's 2 percent target. Real GDP projections for the first quarter of 2018 dropped off quite a bit since last month. In addition, the forecast for unemployment is very pessimistic. One might think that these changes are likely because of the recent jobs report. An alternative hypothesis is that it reflects the changes of the real GDP expectations variable (see my analysis of the April WSJ Forecasts). Below I test those hypotheses: It seems as though the model with out the labor market data would still have more or less the same result in terms of GDP forecasts. However removing GDP expectations data had a huge impact on Q1 forecast of GDP. Recall that the model does not use the expectations data directly, but instead treats them as endogenous variables that can help explain GDP and other variables. Turning to inflation, there is less of a difference between the models in the short run, however, in the long run the lack of labor market data suggest inflation rates closer to the Fed's target. Finally, what I find the most interesting graph, though the most subtle. It seems that the recent labor market data has a strong impact on the dynamic in the unemployment rate. Without the labor market data we see a trough occurring in mid 2019. This suggests that, while the jobs report doesn't have a large impact on GDP, it should change our expectations about unemployment. In addition, expected GDP appears to have a dramatic impact on short-run forecasts of GDP.

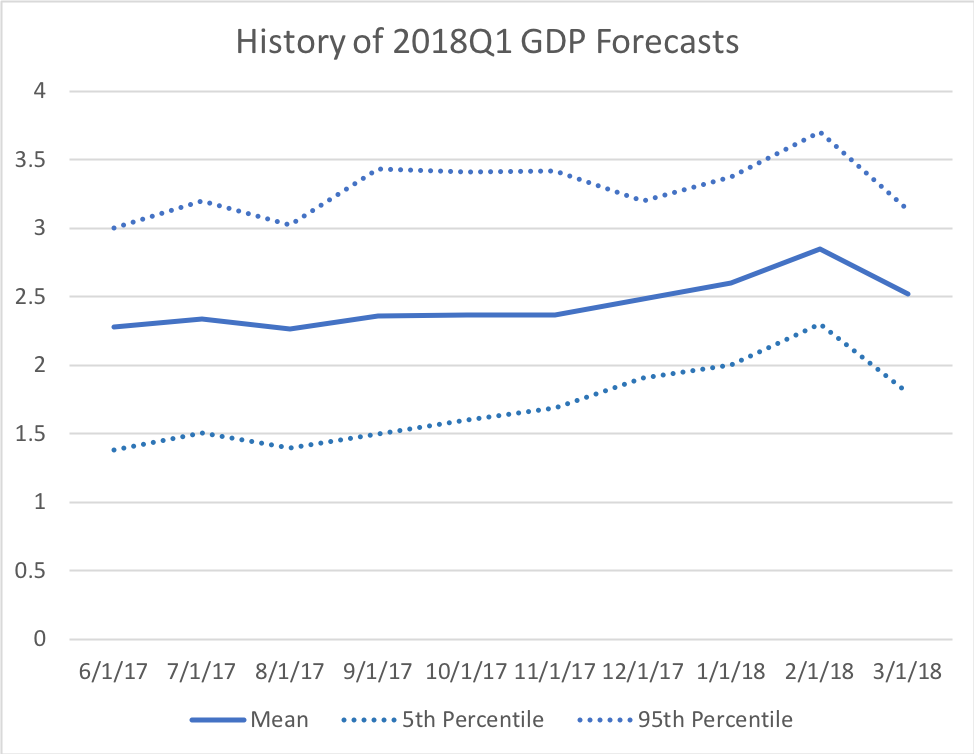

The WSJ Forecasts are out for April and we can observe forecasts staying steady with a few exceptions. Most notably 2018Q1 GDP forecasts fell by almost one half a percent over the last month: While one might immediately think the recent jobs report might have something to do with it, I suspect this is not the case. First, while the reported number was quite low and January and February revisions combined to 50,000 fewer jobs over those months, the 3 month average for Q1 was still about 200,000. Second, the other forecast of GDP growth were more or less unchanged, signaling that, according to the consensus forecasts, underlying fundamentals have not changed much. While the expectation is still for robust growth in the first quarter the reversal in the trend of expectations is a bit surprising.

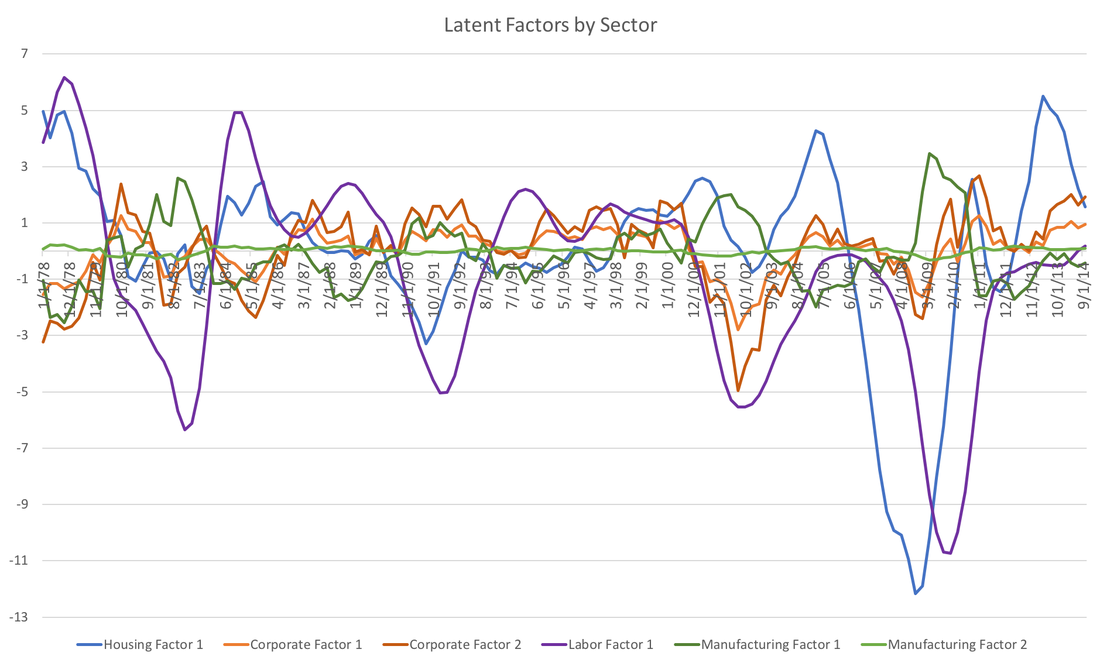

Despite a bit of a reversal in Q1 GDP growth, most other indicators have remained consistent with pst forecasts. If anything long run unemployment expectations grew stronger with the end of 2020 expectations dropping a tenth of a percent. This makes the consensus forecast of unemployment for the coming two years less than 4 percent. Inflation expectations over all horizons rose moderately, and the recent Federal Reserve policy actions and statements have just confirmed our professional forecasts. The only signs of major changes came in crude oil prices expectations, which jumped by a dollar or more after 2018. In addition the recession probability forecast rose 1.67 percent to a little over 15 percent. All in all, the recent data has not moved forecasts drastically. Many of my posts have focused on the WSJ economic forecasting survey. However, I have decided to include my own projections of the US economy. For now I will focus on headline economic data, namely Real GDP, Inflation, and Unemployment, but I plan to add more macroeconomic indicators as I develop more models. The unique aspect of my forecasting methodology is grouping some data series into few sectors (financial, manufacturing, housing, and labor) and including the aggregate measures of expectations I have previously discussed. Please see those previous posts for the methodology behind the aggregate expectations. The sector data uses the cyclical components of several data series within a sector. For example, in the labor market sector I use payroll employment, initial claims, weekly hours, and mean unemployment duration. After generating those cycles I feed them through a dynamic factor model and extract a latent factor series, which I consider markers of broader cycle within the sector. The graph below shows those latent factors: Combining those latent factors of those four sectors with aggregated expectations of inflation, real GDP, and the Federal Funds Rate, we run VARMA(4,0) and forecast 12 quarters out. The bar graph below presents the results for real GDP: The model is optimistic about the second half of 2018. On the whole 2018 looks to be a quite robust year with 2019 showing signs of returning to the average long run growth rate. Turning to unemployment, the model is off a little on the level of unemployment, but I suspect that the dynamics are more or less a good prediction. The trough in unemployment is expected fro the first quarter of 2019. This is a little earlier than the WSJ consensus, but It also seems in line with the slow down predicted in GDP. The forecasts for inflation are a little more surprising. The model predicts low inflation (relative to the Fed's target of 2%) for 2018. If I remove the federal funds rate expectations from the professional forecasters then this drop off in 2018 disappears. Therefore, the impact seem all related to the planned monetary tightening by the Fed.

I plan to make many improvements to this forecasting model, but would be interested in your thoughts... Time again to visit WSJ Economic Forecasts. There was a great jobs report last week and other economic data seem to support a strong medium-run economy in the views of the professional forecasters. The only major downside was a sharp decrease in the forecast of first quarter GDP in 2018 which dropped by a third of a percent to 2.52 percent.

The unemployment rate, which fell below 4 percent with the trough in mid 2019, saw the most optimist changes. This was undoubtedly tied to the jump in payrolls forecasts, which rose by about 20,000 to nearly 200,000 new jobs per month over the next year. The strong jobs report last week drove both of these changes. Most other variables moved only slightly. Inflation expectations changed marginally, but mostly converged in the direction of the 2% Federal Reserve target. Crude oil price forecasts also fell modestly. Housing market expectations for this year and next were mostly unchanged. The consensus recession probability indicator fell slightly to 13.6 percent. Finally, we turn to the yield curve spread (the difference between the ten year bond and the federal funds rate) as we have in previous posts. We have an interesting development as short run forecasts through the end of the year see a riding yield curve spread, indicating a steeper yield curve, and the longer horizon (2020) showed a flatter yield curve. This suggests that forecasters are wary of an impending recession in the longer run. A quick post on the second installment of aggregate forecasts we look at real GDP Growth. As with the inflation forecasts in an earlier post, this measure aggregates several sources of real GDP expectations. Unfortunately there fewer sources and for now I hesitate to include the various Fed nowcasts. The graph below shows the historical real GDP growth rates and the aggregated expectations: And here is the raw data: Finally let's zoom in on the last few years and the latest projections: These aggregated forecasts suggest a robust 2018 and 2019. I suspect, however, that as those longer run forecasts will start to drift further down as the Fed raises rates in response to a tighter labor market.

|

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed