|

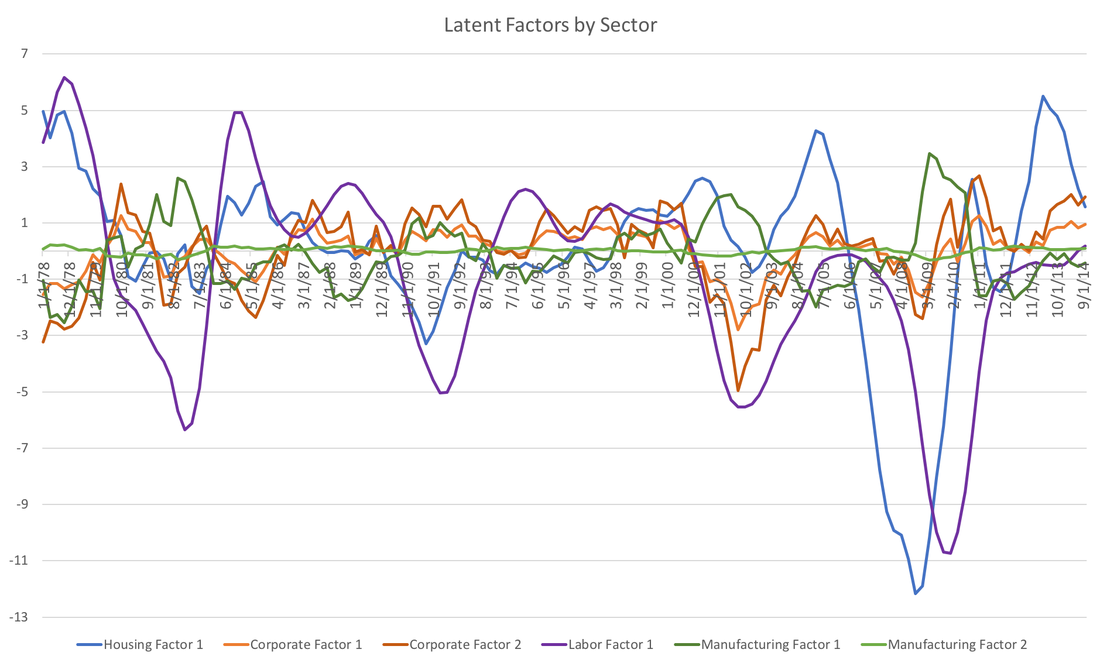

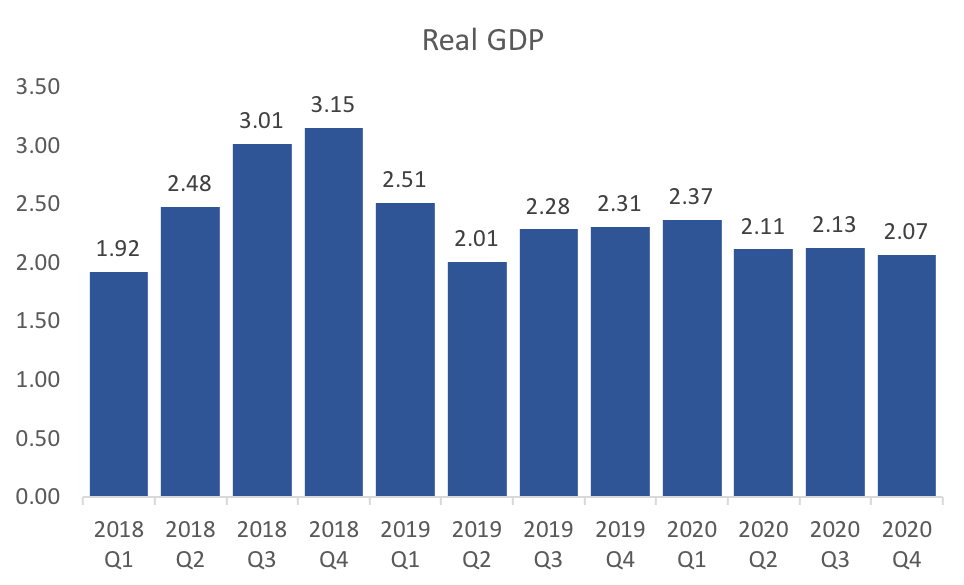

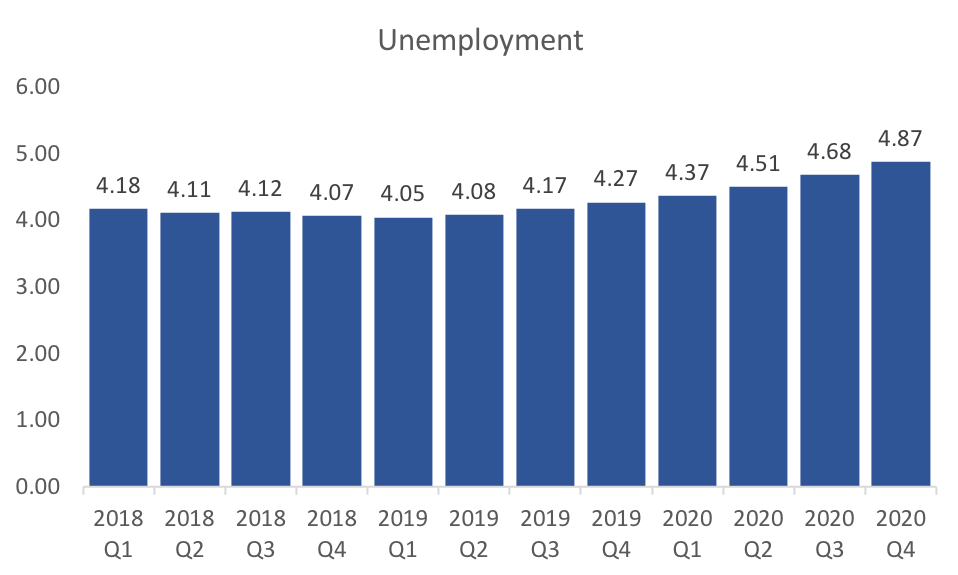

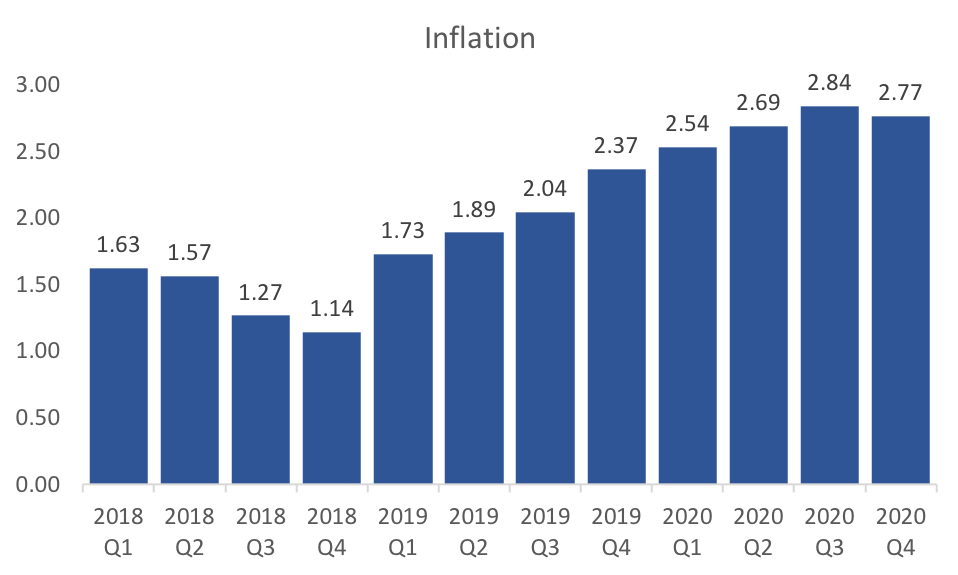

Many of my posts have focused on the WSJ economic forecasting survey. However, I have decided to include my own projections of the US economy. For now I will focus on headline economic data, namely Real GDP, Inflation, and Unemployment, but I plan to add more macroeconomic indicators as I develop more models. The unique aspect of my forecasting methodology is grouping some data series into few sectors (financial, manufacturing, housing, and labor) and including the aggregate measures of expectations I have previously discussed. Please see those previous posts for the methodology behind the aggregate expectations. The sector data uses the cyclical components of several data series within a sector. For example, in the labor market sector I use payroll employment, initial claims, weekly hours, and mean unemployment duration. After generating those cycles I feed them through a dynamic factor model and extract a latent factor series, which I consider markers of broader cycle within the sector. The graph below shows those latent factors: Combining those latent factors of those four sectors with aggregated expectations of inflation, real GDP, and the Federal Funds Rate, we run VARMA(4,0) and forecast 12 quarters out. The bar graph below presents the results for real GDP: The model is optimistic about the second half of 2018. On the whole 2018 looks to be a quite robust year with 2019 showing signs of returning to the average long run growth rate. Turning to unemployment, the model is off a little on the level of unemployment, but I suspect that the dynamics are more or less a good prediction. The trough in unemployment is expected fro the first quarter of 2019. This is a little earlier than the WSJ consensus, but It also seems in line with the slow down predicted in GDP. The forecasts for inflation are a little more surprising. The model predicts low inflation (relative to the Fed's target of 2%) for 2018. If I remove the federal funds rate expectations from the professional forecasters then this drop off in 2018 disappears. Therefore, the impact seem all related to the planned monetary tightening by the Fed.

I plan to make many improvements to this forecasting model, but would be interested in your thoughts...

0 Comments

Leave a Reply. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed