|

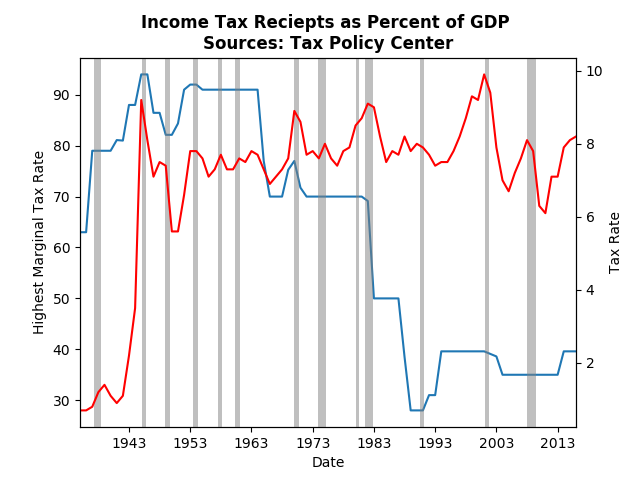

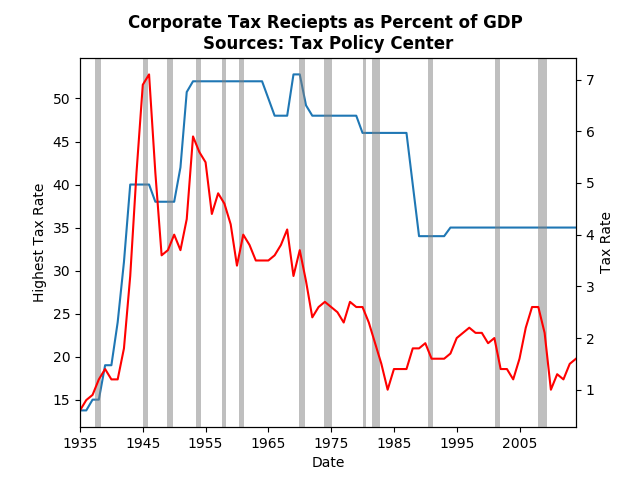

Under the recently announced tax plan rates will be reduced for both corporations and individuals. When considering plans it isn't just the stated rate (12,25,35), or the effective tax rate (what happens after deductions and so on), but also how much income the government receives. This post shows that there despite the drop in income taxes, government receipts have more or less stayed constant for the past 70 years, however, corporate tax receipts have fallen dramatically. Using data from the Tax Policy Center, the graph below shows income tax receipts as a percentage of GDP and the highest marginal tax rate: Note that tax receipts have more or less stayed the same (as a fraction of GDP) regardless of the highest rate. That's because the vast majority of taxes come from the middle. However, the peak of income tax receipts com after the Clinton tax increases in the 90's. It wasn't just the increase in taxes, but also the roaring economy, cutting into the standard arguments of higher taxes hampering growth. In a previous post, I show that tax increase actually lead to higher future growth and tax decreases are more or less ineffective. The graph that I find much more compelling is that of Corporate Taxes: Given how much corporate tax receipts have fallen since WWII and how little corporations contribute to the government, it seems strange that they should receive such a large tax cut (35 to 20 percent). Again there have been plenty of discussions of the effective tax rate, which is actually on par with the rest of the world. It is possible that such a decrease would result in no change in receipts (observe the late 80's), but the political signal seems to say: corporations get a huge cut in burden even though they don't pay very much to the government, and the vast majority of people who do pay get very little change to their tax burden.

0 Comments

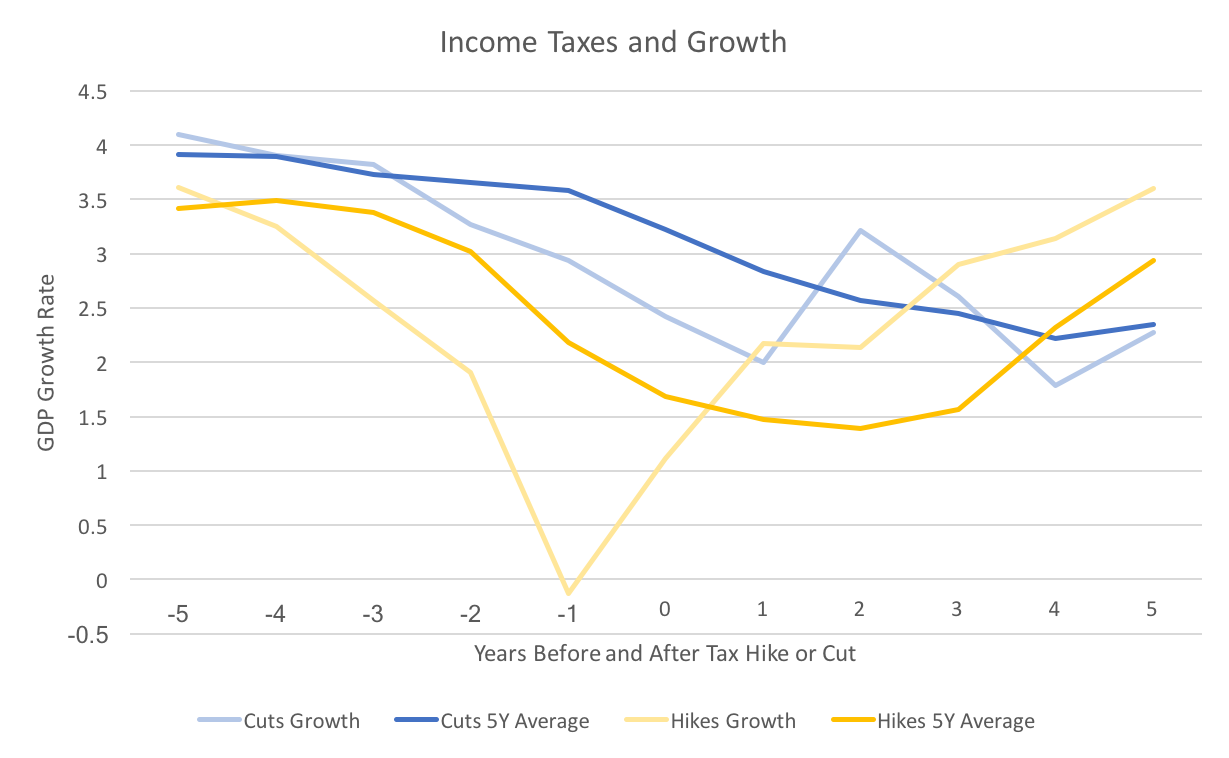

The Trump administration has plans to cut taxes. There have been other blogs and articles that have explained that tax cuts do not necessarily increase growth (see Dietrich Volrath, and Brookings for example). Most of these consider only US economic history, which may be idiosyncratic. Instead, this post will look at recent economic tax policy and economic performance of several OECD countries from 2000 to the present (the data can be found on stats.oecd.org). The graph above depicts the average growth rate before and after a tax policy change. The blue lines represent tax cuts and the yellow lines, tax hikes. The darker lines averages the five year average (annualized) growth rate within each country, and the lighter lines average the one year growth rate. The results confirm what has been found in most research, tax cuts have little impact on growth, and tax hikes can lead to higher growth in the long run.

The figure does a nice job of showing this, but numbers may also put it in perspective. The difference between the five year average before and after a tax cut is -0.877 percentage points. For a tax hike the similar number is 1.256 percentage points. In other words the five years after a tax cut have almost 1 percentage points lower GDP than the five years prior, whereas the years after a tax hike have a 1.25 percentage point increase. Some caveats to this analysis: 1) One might think that a tax cut follows the start of a recession. In this case 4 out of the 15 hikes and 9 of the 37 cuts occurred in 2008 through 2011. Roughly the same percent. 2) Deciding whether there was a tax hike or cut depended upon a change in the marginal income tax rates. Sometimes tax reforms changed both the margins and the rates, making it unclear whether there was a cut or a hike. Those cases were ignored. 3) Finally, the analysis above is crude and one dimensional. It is possible that countries that tend to cut taxes rather than raise them have other characteristics that lead to lower growth. Even with those caveats in mind, the evidence seems pretty clear. The lower tax rates will not be offset by higher economic growth, certainly not to the extent predicted by the administration or Congressional republicans. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed