|

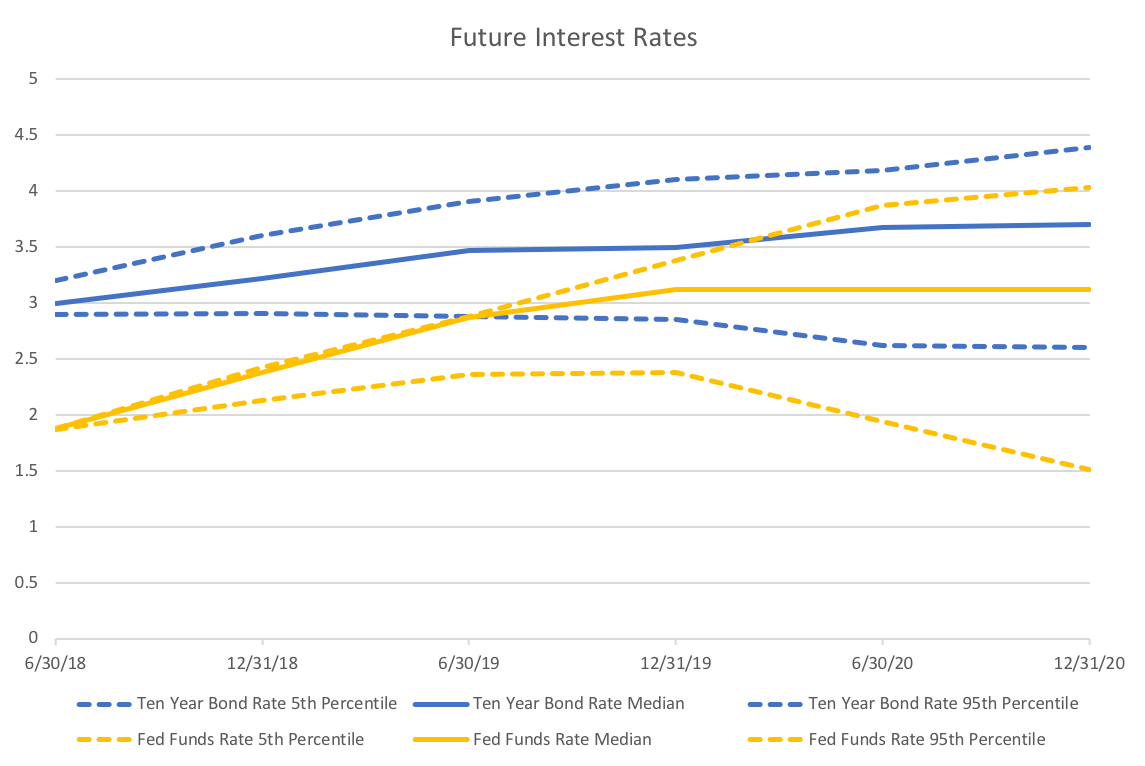

Another relatively quiet month in terms of economic news. The recent data has not done much to shift the views of forecasters very significantly. One of the special questions in this months survey was regarding the timing of the next recession. Ben Leubsdorf of the WSJ does a great job discussing those responses. The big movers this month are crude oil price expectations, which jumped 5.5 dollars for June 2018, and the yield curve spread, which narrowed some more. Oil prices through the end of 2020 are expected to rise but with diminishing amounts, with December 2020 forecasts only rising 1.9 dollars. The yield curve spread is actually quite fascinating as I have noted in past reports. The graph above shows the yield curve tightening through 2020. More importantly, the variability of these forecasts is interesting as well. The difference between the 5th and 95th percentiles grows dramatically for the fed funds rate but is much more stable for the ten-year bond rates. It is unclear whether it is policy uncertainty or economic uncertainty that is driving this difference. However, it is strange that forecasters predict that the long rate will not respond, at least not one for one, to the stated Fed goal of raising rates at least two more time by the end of the year.

Another curiosity: even though the majority of forecasters expect a recession in 2020, they don't seem to think that the Fed will respond to it. If they did I would expect the median fed forecast to at least be fall from June 2020 to December 2020. However, the recession timing predictions are more or less consistent with the consensus unemployment forecasts hitting their low in mid to late 2019.

0 Comments

Leave a Reply. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed