|

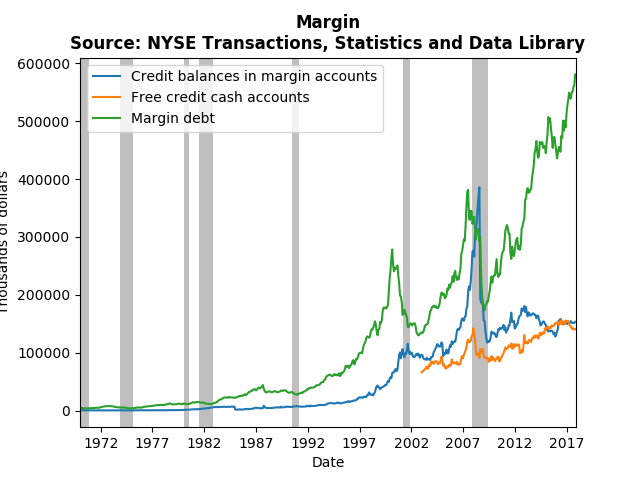

There is a lot of talk about bubbles in the stock market. Robert Shiller used to think there was a bubble, and continues to believe the market correction is coming soon. Paul Krugman is less sanguine, attributing the stock market boom to a global phenomenon and foreseeing economic strength in the future. Given his exhaustive analysis of the Great Recession and the aftermath, I would not expect him to miss an opportunity to warn about another bubble bursting. I more or less agree with Krugman, and I think market participants agree too. Take a look at the dramatic increase in margin debt relative to credit balances in margin accounts in the NYSE: Clearly, the greatest risk takers (those trading on margins) are holding lots of long positions, while keeping short positions more or less constant. There has been a build up of credit in cash accounts, but it seems to be following the general upward trends of stock market participation. What I would be interested to know is whether the additional margin debt is due to new participants trading, or seasoned participants foreseeing long-term growth. If it is new participants, then there almost surely is a bubble. However, seasoned professionals would presumably be taking more short positions if the expected a coming crash. Should global stocks tank in the near future, it should be a big surprise.

1 Comment

The Fed raised rates recently keeping their promise of raising the rate in the face of positive economic data. The WSJ forecasts corroborate this rosy picture of the future economy and improving their forecasts from last month.

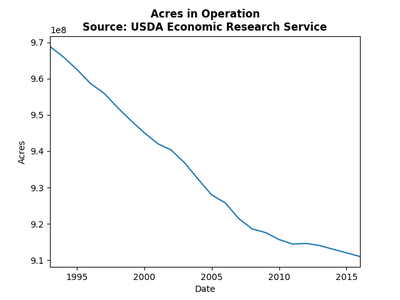

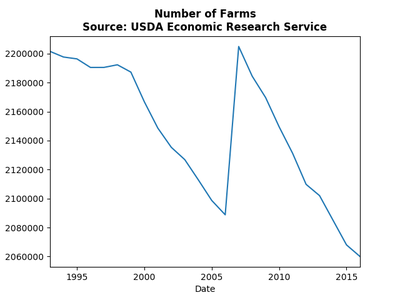

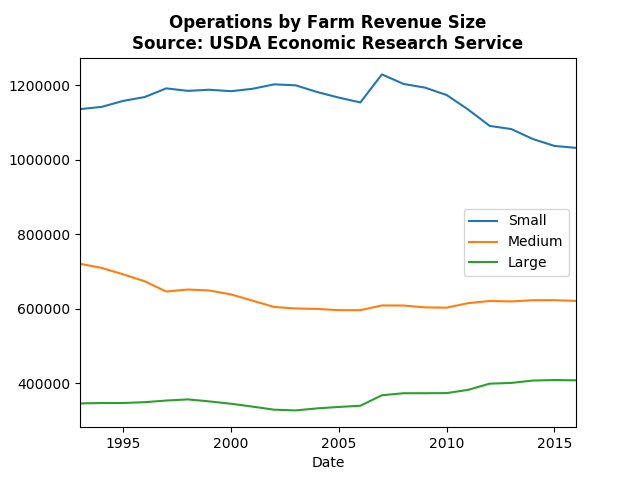

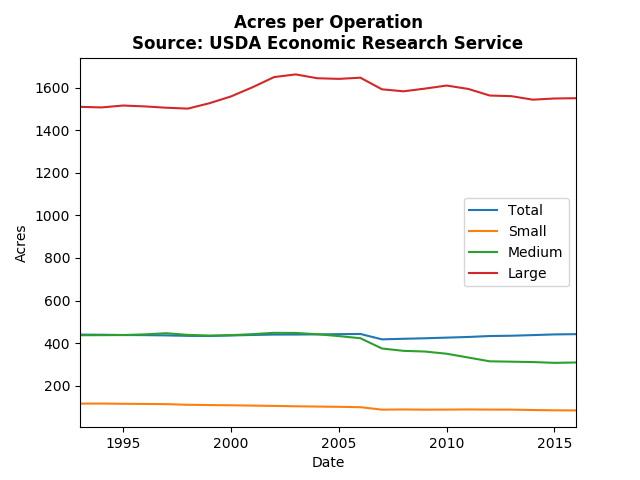

The consensus GDP growth forecast for the coming four quarters rose by a tenth of a percent or more, and all future unemployment numbers went down. It also looks like the forecast for the turning point in unemployment is being pushed out until mid 2019. The consensus probability of a recession in the next 12 months dropped half a percent to 14.1 percent. Some of the details however do not indicate the same degree of certainty in the future economic position. The expected gap between the federal funds rate at ten year bonds continues to tighten signaling a flattening yield curve, which means the Fed may struggle normalize long rates in time for the next recession. Expected housing starts and housing prices dipped a little, but not enough to be overly concerning. Of course it is no surprise given political turmoil in Saudi Arabia, OPEC extension of production cuts, and now the North Sea pipeline problems, that expected oil prices increased significantly. Expected prices increased by 2 dollars or more through 2018. All in all, there is a strong belief amongst the Fed and professional forecasters that board scope economic futures look robust, but there are still some potential weaknesses. My foray in to the turkey industry piqued my interest in agriculture in general. So this post explores what the trends in farming. Most economists discuss the structural change that occurs in economies by noting that farming used to command 60% of the labor force, and now less than 2% of the labor force is engaged in farming. Shifts of that magnitude result in changes in culture and policy, some times those changes take a long time to take effect (daylight savings anyone?). Continuing that trend, the graphs below show that the number total number of farms and acres operated have been declining over the past 23 years: The jump in 2007 was the result of a dramatic rise in small scale farms as we approached the great recession. However, the decline in acres in operation clearly indicates a decrease in land use. This is surprising because both exports and imports of agricultural products are increasing. The US remains a net exporter of agricultural products, which suggests the changes we see in the farming industry are a result of economies of scale: The number of small farming operations has decreased dramatically since the great recession, and the large scale farms are increasing. At the same time we do not observe a drastic change in the number of acres operated per farm: The only thing to note regarding acre per operation, is that medium scale farms are shrinking in size. Large scale farms purchasing the largest of the medium scale farms, or mergers of medium scale farms might explain these trends, but this can't be teased out of this data with certainty.

|

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed