|

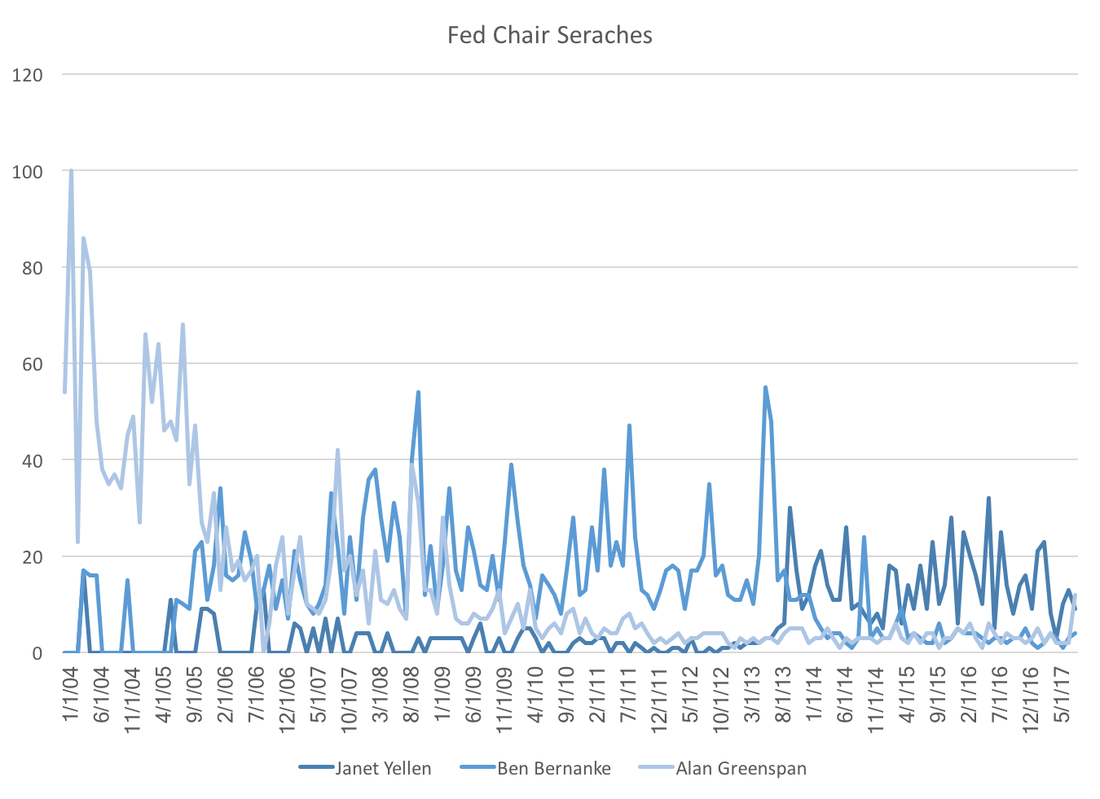

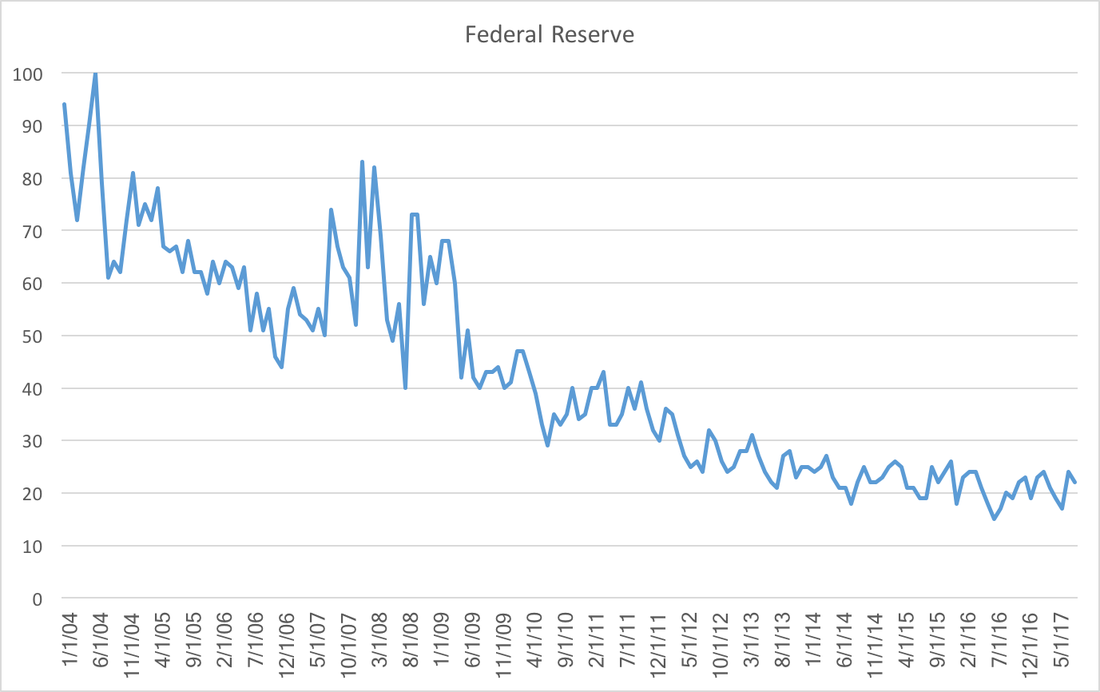

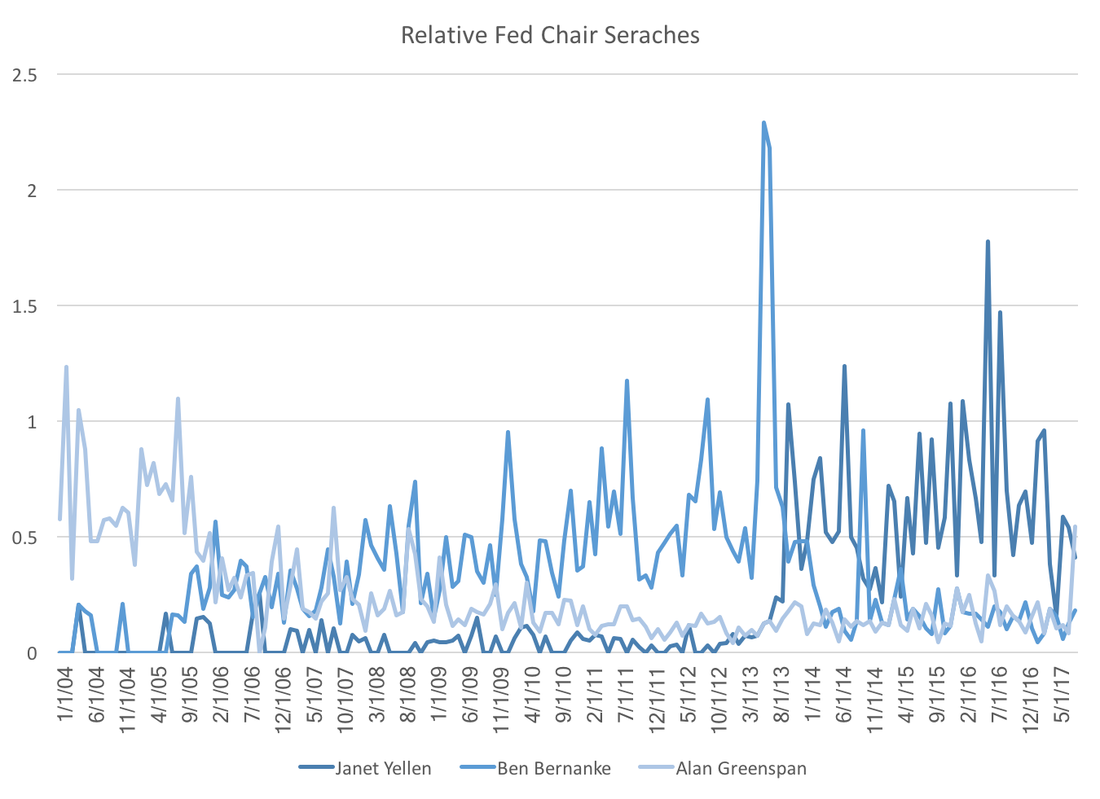

Economists model the economy, which really means we model thinking and decision making. A post from a few weeks ago showed that professional forecasters display less future federal funds rate uncertainty. Could this reflect a more general trend of individuals having more information about the federal reserve system? The most visible member of the Federal Reserve is the Chair, and google trends provides excellent data on the relative frequency of Fed Chair searches: As each chair transitions we see the appropriate shifting of search traffic from one person to the other. The notable difference the relatively low number of searches of current chairwoman Janet Yellen. It appears this is an artifact of declining interest in the Federal Reserve searches in general: Re-weighting the first graph by the second we see that relative to Federal Reserve searches, Janet Yellen has been searched for at least as much previous Fed Chairs: While it is nice to know that there does not appear to be a gender bias, a puzzle remains. Why has fed funds rate forecast uncertainty decreased while interest in the federal reserve has waned? Perhaps searches have declined because the Federal Reserve has done a better job at communicating future policy, which eliminates the need for gathering additional information.

0 Comments

|

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed