|

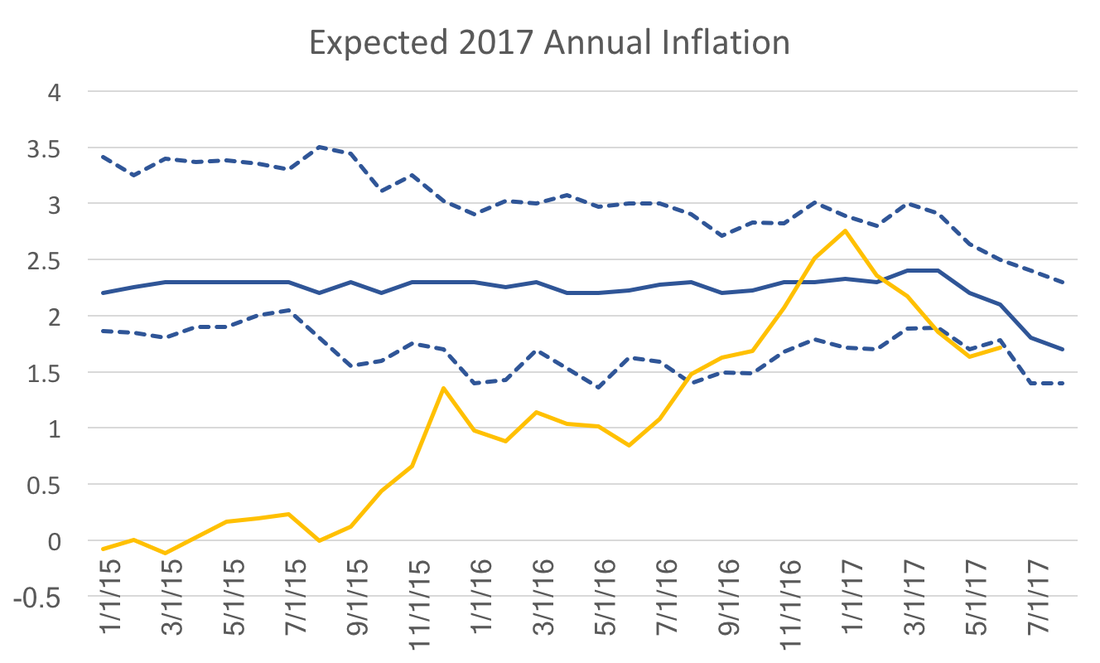

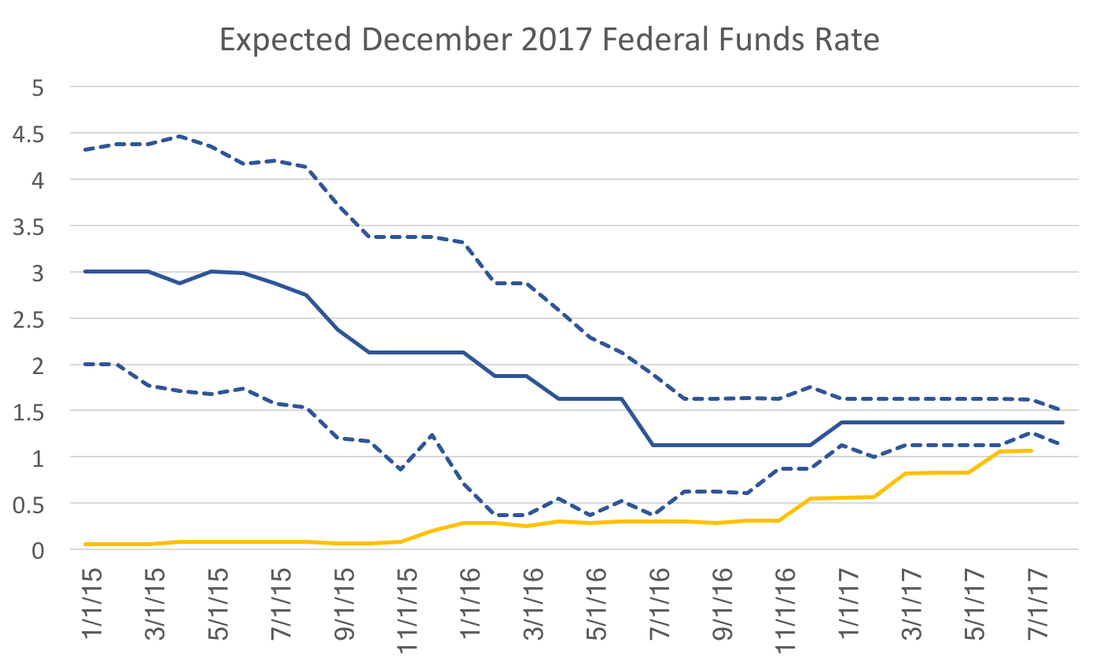

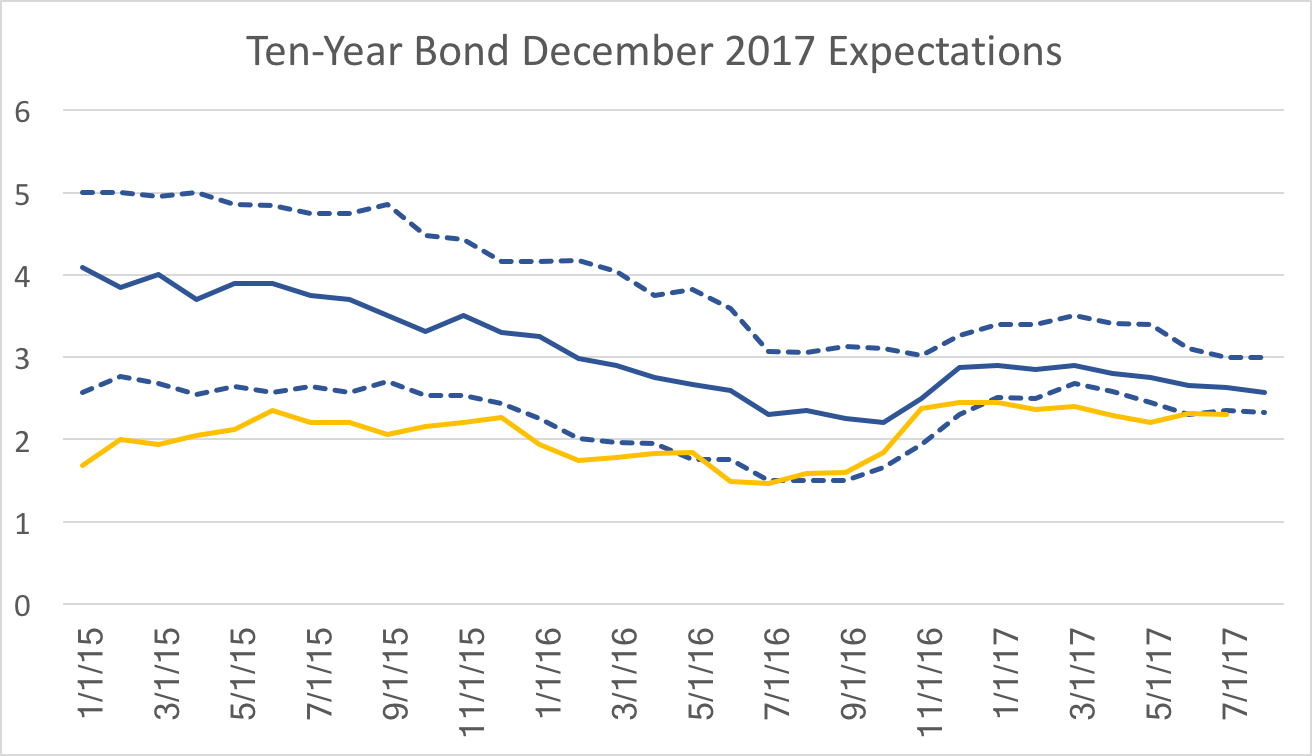

A logical analysis of expectations might argue that historical averages drive long-run forecasts with macroeconomic fundamentals and announced policies providing slight mitigation. In contrast, recent economic data drive short-run forecasts. WSJ expected inflation for 2017 provides a good example of this: Almost 3 years in advance, the forecasts match the Fed's stated policy and historical averages. At the beginning of the 2017 it looked as though year over year CPI inflation (yellow line) and expectations were converging. However, the last few months of slow price growth have caused expectations to dip following, with a lag, the path of year over year inflation. This post points out that this pattern of behavior need not exist for all variables. Instead consider the federal funds rate. These expectations, more so than those for inflation, driven by mostly by policy statements and projections released by the Federal Reserve. It is therefore not surprising how high expectations were at the beginning of 2015 and how quickly they have fallen over the past 2 years. In 2015 the discussion was over normalization of policy or "the lift-off," but the data at the time did not support action at that time. As policy statements and Fed projections became more clear expectations dropped quickly. Notice also the drop in uncertainty, a point I have emphasized in a previous post on federal funds rate expectations. The drivers of inflation and the federal funds rate have no direct impact on the bottom line of the forecasters or the firms for which they provide their forecasts. However, take ten-year government bond rates for example: These expectations more closely follow the path of the actual bond rates even 2-3 years in advance of the realization. While bond rates should, in theory, be just as sensitive to monetary policy one would expect a similar pattern, however the gap observed at the beginning of this series does not appear as wide and the overall time-series movement between expectations and actual observations are remarkable similar.

How we think about long-run and short-run expectations depends critically on the relative importance of the outcome to our objectives.

0 Comments

Leave a Reply. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed