|

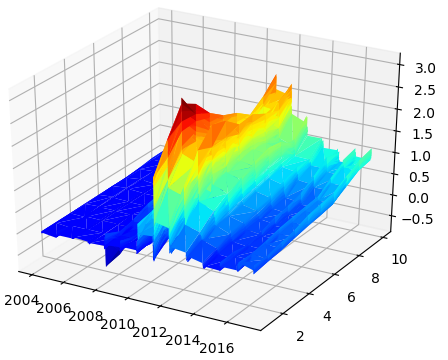

Another type of post, though one that will appear less frequently, will relate to my research. My recently published article with Arunima Sinha investigates Euro yield curves. We noticed that AAA Euro yields were far more stable during the financial crisis and subsequent debt crisis than those of lower credit ratings. Our paper highlighted the implications on how expectations might be formed across these two different risk pools. This was made possible because the ECB collects data on two categories of yield curves one with AAA Euro bonds and another with all-ratings Euro bonds. This post, however, addresses someting not brought up in the paper. Using these data on yields with varying risk, one can calculate a risk spread (subtracting AAA yields away from all-ratings yields). The larger the spread for a paticular maturity (say a 1Y bond) would indicate greater risk for defaults over that time horizon (1Y). In doing so, one can visualize the story of the financial crisis and European debt crisis. It can also shed some light on the current risks. (This data is freely available on the ECB's Statistical Data Warehouse.) Below is a 3D plot of that data from September 6, 2004 until May 5, 2017 on ten different maturities (3M, 6M, 1Y, 2Y, 3Y, 4Y, 5Y, 10Y, 20Y, 30Y). The heatmap shows at what point in time risks peak for the various maturities. For the first few years risks were negligible. Through the beginning of the financial crisis in the US, risks increased slightly, but tapered off mid-2009 leaving only the long-run spread (10Y and 20Y maturities) elevated. Throughout 2010 and 2011 the medium-run (2Y, 3Y, 4Y, and 5Y) and long-run (10Y, 20Y, and 30Y) spreads continually edged higher until November of 2011 where it peaked in the 1Y and 2Y maturities from the 25th to the 28th. This coincides with the hieght of the debt crisis. However, looking back we can see that the medium-run spreads were about the same or higher than the long-run spreads starting back in July and August. This suggests that market participants registered the danger fairly early on. As a description of the debt crisis the AAA-all bonds spread provides a detailed map of how information influenced the debt risk. While spreads have not recovered to their pre-crisis levels they did recover significantly since 2011. They were almost fully recovered at the end of 2014 into 2015. However, recently, perhaps in response to continued pressure from populist candidates at the polls, spreads of started rising again. The levels we are seeing now in the medium-run are similar to those of mid-2010 and the long-run levels are similar to the end of 2010 beginning of 2011. It would not be prudent to consider this risk spread as an indicator of another impending debt crisis, but it does put into perspective the level of risk markets perceive in the relatively debt-ridden European countries.

0 Comments

Leave a Reply. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed