|

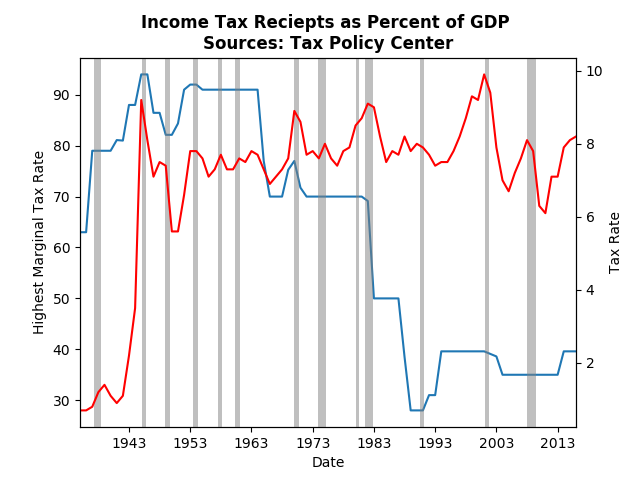

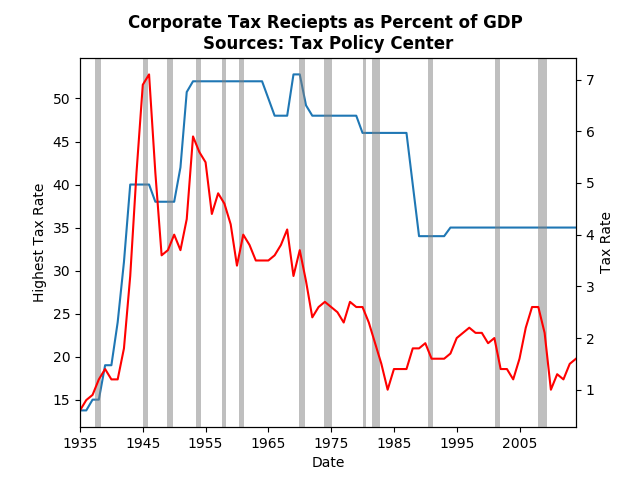

Under the recently announced tax plan rates will be reduced for both corporations and individuals. When considering plans it isn't just the stated rate (12,25,35), or the effective tax rate (what happens after deductions and so on), but also how much income the government receives. This post shows that there despite the drop in income taxes, government receipts have more or less stayed constant for the past 70 years, however, corporate tax receipts have fallen dramatically. Using data from the Tax Policy Center, the graph below shows income tax receipts as a percentage of GDP and the highest marginal tax rate: Note that tax receipts have more or less stayed the same (as a fraction of GDP) regardless of the highest rate. That's because the vast majority of taxes come from the middle. However, the peak of income tax receipts com after the Clinton tax increases in the 90's. It wasn't just the increase in taxes, but also the roaring economy, cutting into the standard arguments of higher taxes hampering growth. In a previous post, I show that tax increase actually lead to higher future growth and tax decreases are more or less ineffective. The graph that I find much more compelling is that of Corporate Taxes: Given how much corporate tax receipts have fallen since WWII and how little corporations contribute to the government, it seems strange that they should receive such a large tax cut (35 to 20 percent). Again there have been plenty of discussions of the effective tax rate, which is actually on par with the rest of the world. It is possible that such a decrease would result in no change in receipts (observe the late 80's), but the political signal seems to say: corporations get a huge cut in burden even though they don't pay very much to the government, and the vast majority of people who do pay get very little change to their tax burden.

0 Comments

Leave a Reply. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed