|

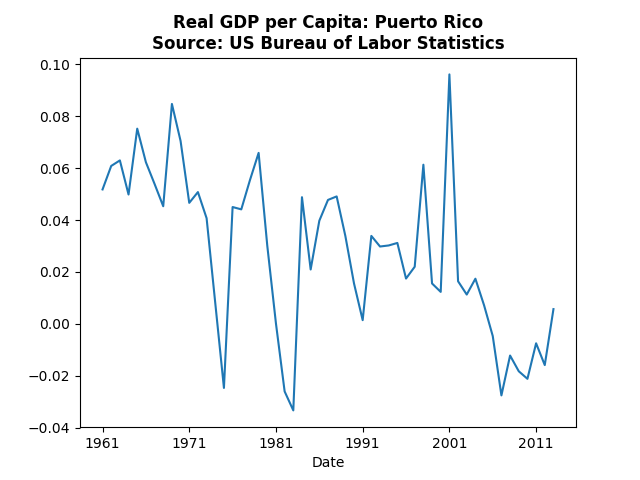

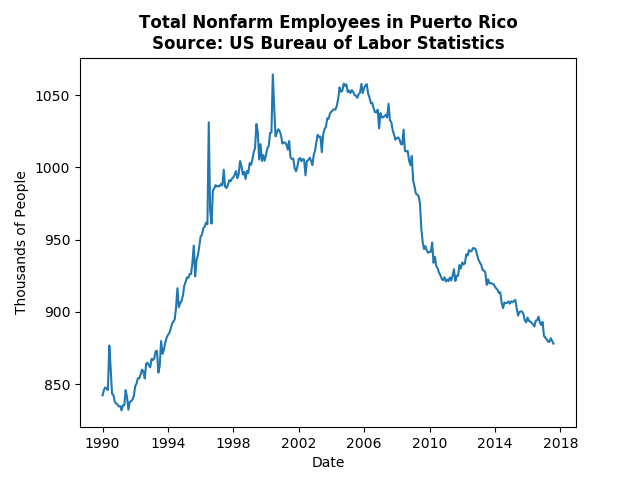

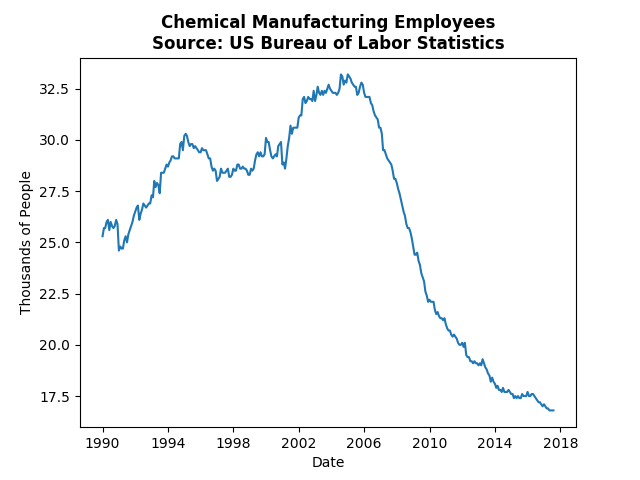

A good friend of mine, Chris Gibbs at UNSW-Sydney, mentioned some of the things that led to Puerto Rico being in its current debt position (hurricane not included). This post tells that story in graphs. The first is one that everyone has been talking about, that Puerto Rico has been in a recession for several years: Real GDP per capita has been negative or just barely above zero from 2005 until 2013. Note that the downturn occurred prior to the financial crisis. Before that Puerto Rico enjoyed strong growth except for the impact of the recessions in the 70's and 80's. The gradual decline in GDP growth also makes sense since they were catching up to mainland United States. The argument some bring up is that the local government has been spending too much, instead the long recession lowered tax revenues. One might argue that the Puerto Rican government should have controlled the situation, but the reason for the sudden prolonged recession was actually due to US policy. Prior to 1996 Puerto Rico benefited from a provision in corporate tax law that encouraged businesses to locate there. However, Bill Clinton signed a law in 1996 that would undo that special status, because companies were perceived to use that law to evade taxes. Ten years later that law took full effect. And here were the consequences: Jobs just started disappearing after 2006 and have not really recovered since. To be clear, the bill that Clinton signed was likely appropriate policy in terms of corporate taxes, but it failed to consider the ramifications to the people of Puerto Rico. Where did this drop off come from? Well take a look at the pharmaceutical/chemical industry: That steep decline starting in 2006 was a direct result of the tax policy changes. As the businesses left, and the high paying jobs left with them, the impact was textbook economic death spiral. Consumption of services by the wealthy who have left disappears, which causes those service industries to fire their employees. Those employees no longer have money to afford other goods and services and so the firms that rely on them have lower demand an must fire some more employees and so on.

Puerto Rico did have 10 years to prepare for the change, and they did end up signing some territory tax incentive laws, but after decades of special tax policy they probably did not understand the impact of losing that status. Which is to say, when the administration blames Puerto Rico's current debt and predicament on bad policy the administration may be correct. Except, the bad policy was the Federal government leaving Puerto Rico in the lurch when taking away a major influence of the Puerto Rican economy.

0 Comments

Leave a Reply. |

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed