|

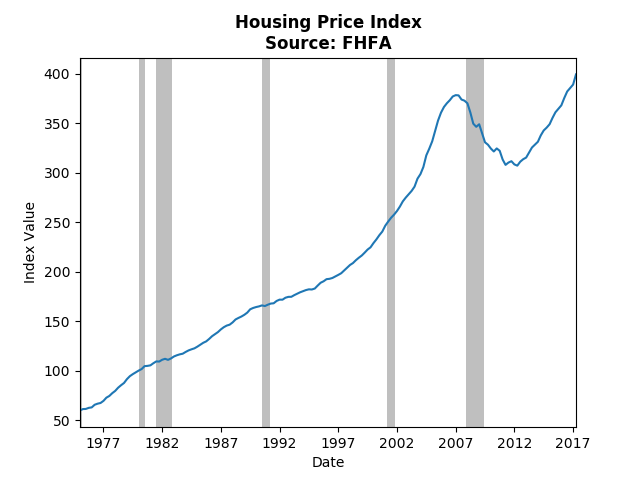

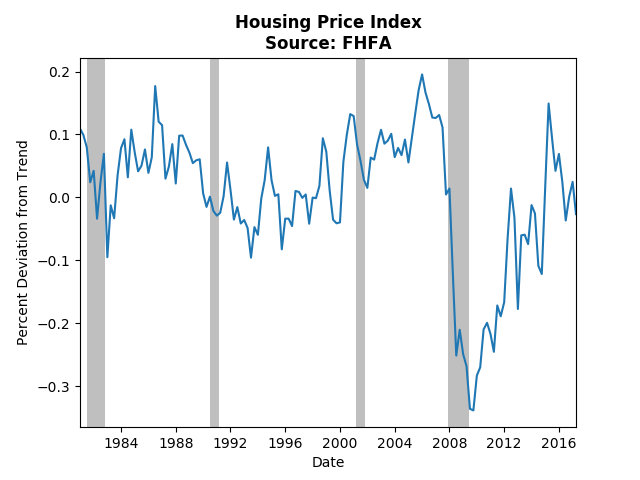

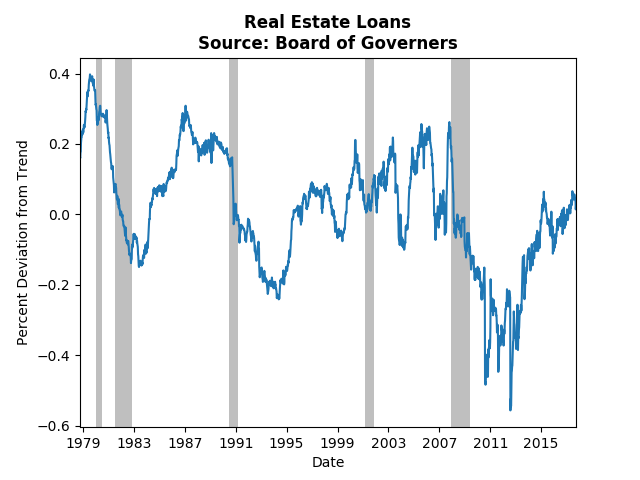

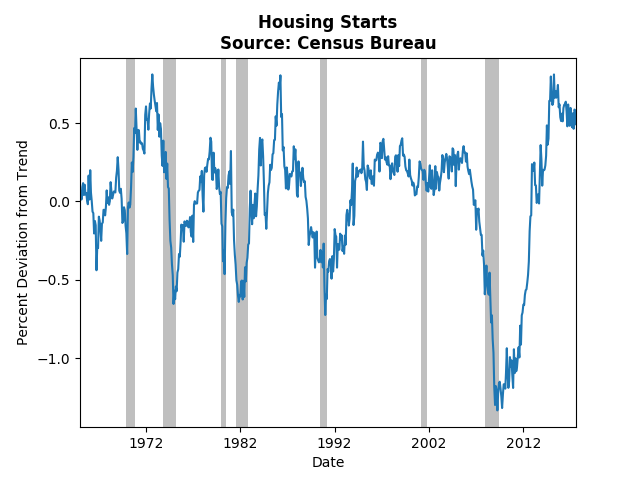

Several sources have discussed the possibility of a hosing bubble (see The Great Recession Blog). Most people who make this claim point to the following graph and say prices are now higher than they were pre-crisis: I think it is fair to say there definitely was a bubble before the recession, but the housing market has really only made it back to it's trend. If we look at a graph of the housing market cycle we can see that the previous bubble was due to spending almost a decade well above trend: That decade led people to believe housing prices always increase and caused them to engage in risky borrowing. However, the drop in housing prices was so severe that it has taken almost a decade just to get us back to trend. Real estate loan data more or less supports this claim: Realestate loans were severely depressed for about four years post recession, and only in the past two years have we approached the trend. One area where that may indicate the beginnings of a new bubble is housing starts: There have been very few experiences in the past 50 years where starts have been above trend this much for so long. One could argue this signals excessive growth in housing. However, the increase in supply should, according to basic economic theory, depress housing prices and stave off any bubbles.

1 Comment

|

Archives

May 2018

Categories

All

|

RSS Feed

RSS Feed